Jerome Powell hints at possible easing of banking regulations on cryptocurrencies

Jerome Powell, the chairman of the US Federal Reserve, has indicated a major shift in the regulation of digital assets by banking institutions. During an interview at the Economic Club of Chicago, Powell acknowledged the excesses and abuses of the sector while also suggesting that the current momentum is moving towards a wider integration of cryptocurrencies into the financial system.

Towards a regulatory paradigm shift for crypto

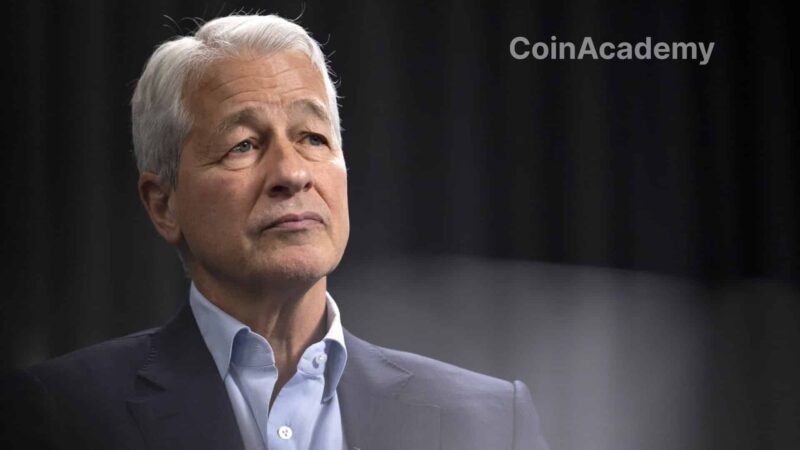

We have taken a fairly conservative approach, and other banking regulators have taken an even more conservative approach regarding the guidelines and rules we have imposed on banks. I think there will be some relaxation in this regard.

Jerome Powell

‘We have taken a very cautious approach,’ he admitted, noting that other banking regulators have been even more restrictive. However, the time seems to be ripe for change. Powell now envisions ‘some easing’ of the rules governing banks’ crypto-related activities, promising not to sacrifice the stability of the financial system.

His goal? To find a balance between innovation and security. Future regulatory developments will need to allow banks to explore the opportunities offered by cryptocurrencies without endangering either institutions or consumers. Powell emphasizes the need to protect users from risks that they do not yet fully understand, while supporting a reasoned adoption.

The Trump administration’s pro-crypto stance

This shift comes in a political climate conducive to reform. Since Donald Trump’s return to the White House, federal banking agencies have been transforming their approach to the subject. Last month, the Federal Deposit Insurance Corporation (FDIC) announced that it would abandon its previous guidelines, allowing institutions under its supervision to engage in crypto-related activities without prior authorization.

Meanwhile, the Office of the Comptroller of the Currency (OCC) has also clarified that these activities are now fully compatible with the federal banking system.

Stablecoins at the heart of legislative priorities

Parallel to this, the US Congress is accelerating its focus on stablecoins. Bills regulating these digital assets have been adopted in committees, both in the House of Representatives and the Senate. Donald Trump has expressed his intention to sign this legislation ‘as soon as possible,’ in his own words.

For Powell, this legislative initiative is a major step forward. Stablecoins, he believes, ‘are digital products that can have broad utility,’ as long as they are accompanied by ‘traditional consumer protections’ and increased transparency. Political consensus seems to be emerging in favor of clear regulation of these future monetary instruments.