Ethereum Spot ETFs recorded a net inflow of $106.78 million on their first day of listing, with the majority of funds on the rise. Transaction volumes exceeded $1 billion, marking a promising start for these new financial products.

Comparing with Bitcoin Spot ETFs

By comparison, Bitcoin Spot ETFs reached a $4.5 billion transaction volume on their first day, with a net inflow of $600 million. Investors traded over a billion dollars’ worth of shares in the new Ethereum Spot ETFs upon their availability, according to Bloomberg data. Of that billion dollars, the net inflow was $106.7 million, as reported by a SoSoValue tracker.

Funds Movement and Volume Comparison

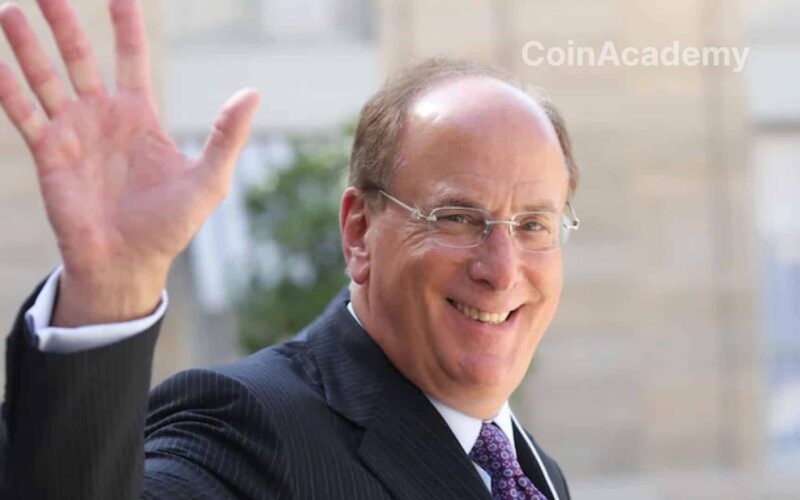

A significant portion of the inflow came from withdrawals from the Grayscale Ethereum Trust (ETHE), which saw an outflow of $484 million. The BlackRock iShares Ethereum Trust (ETHA) recorded the highest inflow with $266.5 million, followed by the Bitwise Ethereum ETF (ETHW) with $204 million.

The total transaction volume reached $1.077 billion, approximately 20% of the Bitcoin ETF transaction volume at launch in January. Many market observers had speculated that the volume and inflow for ETH ETFs would be less impressive due to the absence of a staking mechanism, but the first-day results show strong demand and sustained interest.