The Weekly Corner is the ultimate gathering to stay up to date on crypto, NFT, DeFi & GameFi news of the week! 📰

SEC Cannot Reject Ethereum Spot ETF, According to Coinbase’s Legal Chief Grewal

Paul Grewal, Coinbase’s Legal Chief, firmly asserts that there is no valid justification for the SEC to reject Ethereum Spot ETF proposals, based on Ethereum’s status as a commodity and previous regulatory statements.

This argument arises in a context where Ethereum’s classification, especially after its transition to a proof-of-stake consensus mechanism, is the subject of intense discussions.

While the SEC’s decision remains uncertain, Grewal and other proponents of Ethereum Spot ETF approval highlight Ethereum’s historical position as a non-security and its distinction from traditional securities, despite regulatory challenges and speculation about its legal future.

ETH: Vitalik Wants to Combat Ethereum’s Centralization with Rainbow Staking

Vitalik Buterin’s strategy of “Rainbow Staking” is divided into two forms: “heavy staking,” which involves penalties and the responsibility to sign at each interval, and “light staking,” which is exempt from penalties and randomly designated for signing. This distinction aims to enhance the security of the Ethereum network by requiring the agreement of two categories of stakers to approve a block, aiming to balance the security merits of each type while avoiding a single liquid staking token taking over ETH.

The “Rainbow Staking” initiative aims to revalue the position of “solo staker” by encouraging fair competition, while recognizing the need for further research to refine this concept. Buterin also raises philosophical considerations about the engagement of ETH holders who seek to generate passive income while supporting the security of the platform.

More info: https://coinacademy.fr/actu/eth-vitalik-combattre-centralisation-ethereum-rainbow-staking/

“To me, the biggest questions here aren’t even technical; they’re philosophical,” said Buterin, noting that it is important to understand the intended response behind the means of allowing “lazy ETH holders” who want rewards to participate in securing the Ethereum network.

Ether.fi Redefines Distribution of ETHFI in Response to Community Concerns

Ether.fi, a leader in liquid restaking on Ethereum, announces the launch of its ETHFI governance token, with redistribution following community concerns about the initial allocation.

In response to the controversial allocation of 6% of the airdrop to Justin Sun after a notable deposit, and community feedback, Mike Silagadze, founder of Ether.fi, increases the share of community members in the airdrop.

Ether.fi has defined a total supply of one billion tokens, with an initial circulating supply of 115.2 million tokens.

The first distribution step, called Season 1, will unlock 6% of this total supply, taking into account interactions with the protocol until March 15, 2024. Following that, Season 2 will allocate 5% of the supply for actions performed after that date, although the end of this phase is not specified.

Eligibility for this airdrop varies and may include possession of eETH, engagement with the protocol, sponsorship of new members, or participation in liquidity pools. Notably, a new system imposes a three-month delay for “whale wallets” to claim their tokens, while smaller wallet holders can do so immediately.

OKX Adapts to MiCA in Europe by Replacing USDT pairs with EUR and USDC

In response to regulatory developments in Europe, OKX is modifying its trading offerings by removing USDT pairs in favor of EUR and USDC pairs.

This decision aligns with the European Union’s MiCA (Markets in Crypto-Assets) legislation, which aims to regulate stablecoins and other cryptographic assets. While the exact reasons for the removal of USDT pairs are not explicitly linked to MiCA regulations, references to “regulatory requirements” suggest proactive adaptation by OKX to current standards.

The announcement is accompanied by the introduction of over 30 new trading pairs in euros, anticipating compliance challenges and MiCA’s specifications, expected to be fully implemented by the end of 2024.

Reminder: The European Union’s MiCA (Markets in Crypto-Assets) legislation is scheduled to come into full effect by the end of 2024, with anticipated early enforcement of rules related to stablecoins by the second quarter of 2024.

Network Abstraction, Cross-Chain Management: Light Rethinks the Use of EVM Blockchains

Light revolutionizes the use of EVM chains with advancements such as network abstraction, unified cross-chain asset management, and batch transactions, offering a seamless and unified user experience.

This platform introduces a method to conduct multi-chain transactions using any asset for fees, as well as a single smart wallet for simplified asset management across all chains.

Light also offers the ability to perform multiple asset transfers in a single operation, revolutionizing interaction with EVM-compatible blockchains. By committing to a 100% open-source approach, Light aims to facilitate the adoption of its innovations, promising significant improvement in interoperability and user experience in the blockchain ecosystem.

Imagine making a payment in USDC on Arbitrum and Optimism while covering transaction fees (gas) in USDT on Polygon, all in one transaction. That’s what Light offers, which also allows you to pay gas fees with any asset held on these blockchains.

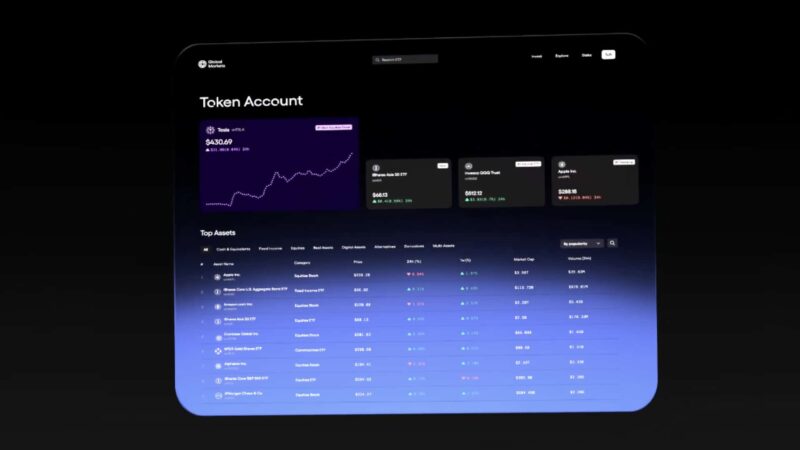

BlackRock Launches Tokenized Asset Fund on Ethereum

BlackRock, an investment management giant, takes a decisive step into the world of cryptocurrencies with the launch of the BlackRock USD Institutional Digital Liquidity Fund, in collaboration with Securitize.

With an initial $100 million in USDC, this fund, based on the Ethereum blockchain, builds on BlackRock’s exploration of digital assets, previously marked by the success of its Bitcoin Spot ETF.

With this move, BlackRock not only affirms its position in the tokenization of real assets but also envisions a revolution in traditional finance, promising increased speed and efficiency in transactions and asset management.

This initiative could mark a significant turning point for the future of tokenization, immediately impacting the sector with a 20% increase in the ONDO token of the RWA platform: Ondo Finance.

In Brief

- The DOJ demands 40 to 50 years in prison for Sam Bankman-Fried

- GCR buys Achi’s NFT, Dogwifhat’s iconic dog, for $4 million

- The court sanctions the SEC for a “gross abuse of power” in the Debt Box case

- Genesis agrees to pay a $21 million fine to settle its lawsuit with the SEC

- ETH: SEC delays decision on Hashdex and ARK 21Shares’ Ethereum Spot ETFs

- Coinbase: Base blockchain sees skyrocketing fees due to overloaded activity

- FTX had only 105 BTC left in its wallets at the time of bankruptcy

- CHZ: EDF subsidiary, Exaion, becomes a validator on the Chiliz blockchain

- NFT: CryptoPunks records a new record sale of $16 million in March