78% of institutional traders surveyed by JPMorgan have no plans to trade cryptocurrencies in the next five years. Only 7% of participants consider blockchain to be an influential technology for the future of trading, down from 25% in 2022. 61% of traders expect artificial intelligence and machine learning to shape the future of trading in the next three years.

Details of the JPMorgan survey

JPMorgan’s annual e-Trading 2024 survey of over 4,000 institutional traders reveals a clear reluctance to engage in cryptocurrency trading. Only 12% of participants are considering entering the cryptocurrency trading market in the next five years, while a minority sees blockchain as an influential technology for the future of trading.

78% of traders surveyed have no intention of trading cryptocurrencies or digital tokens. 12% of traders plan to transact within the next five years.

JP Morgan e-Trading 2024

Shift in technological interest

Compared to previous years, interest in blockchain has significantly decreased, dropping from 25% in 2022 to just 7% in 2024. On the other hand, artificial intelligence and machine learning have gained importance, with 61% of traders predicting them to be the most influential technologies for the future of trading.

Despite an initial cooling off of the digital currency sector in early 2022, the entry of financial giants and the approval of Bitcoin Spot ETFs in the United States in January 2023 have contributed to a gradual recovery of the sector. However, the majority of traders surveyed still have no intention of trading cryptocurrencies, reflecting persistent caution towards this sector.

JPMorgan’s view on digital assets

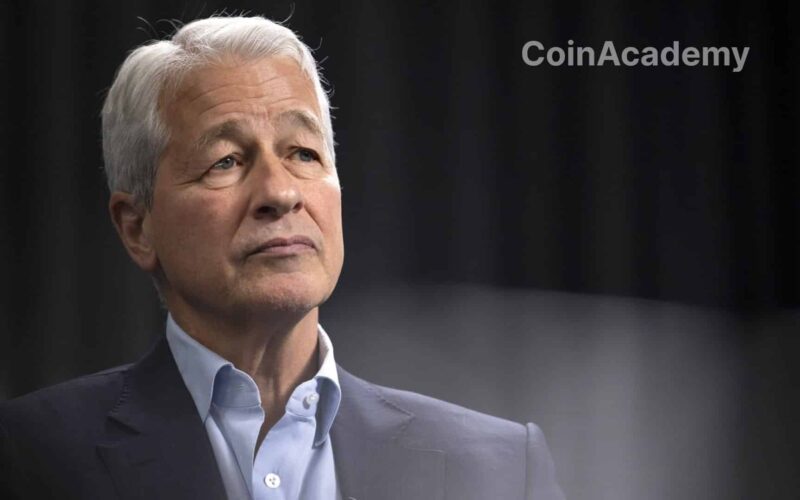

Although JPMorgan has been active in the digital asset space, CEO Jamie Dimon has expressed skepticism towards cryptocurrencies, comparing them to a “useless” “pet rock” and advising against getting involved.

Survey participants identified inflation, US elections, and the risk of recession as the key catalysts likely to influence the market this year, highlighting the potential impact of these events on trading decisions.