In a notable turnaround, the SEC has decided to drop its allegations against Ripple CEO Brad Garlinghouse and executive chairman Chris Larsen regarding their role in the alleged securities law violations related to XRP transactions. This announcement cancels an upcoming trial scheduled for next year, marking another milestone in Ripple’s ongoing legal journey against the regulator.

SEC vs Ripple: A Legal Battleground

In a statement, Garlinghouse expressed relief at the SEC’s decision. Highlighting the regulator’s misplaced priorities, he stated, “For nearly three years, Chris and I have been targeted with unfounded allegations by a regulator with a political agenda. Instead of targeting offshore exchanges involved in illicit activities, the SEC chose to go after us. “

Garlinghouse said: “For nearly three years, Chris and I have been targeted with unfounded allegations by a regulator with a political agenda. Instead of targeting offshore exchanges involved in illicit activities, the SEC chose to go after us.”

In July, Ripple achieved a significant but partial victory. Judge Analisa Torres ruled that the firm’s provision of XRP to retail investors via exchanges was not a violation of federal securities laws. However, direct sales of XRP to institutional buyers were deemed to be in violation. This is the point on which the SEC seems determined to delve deeper, as recent filings indicate.

Describing the SEC’s withdrawal as a “surrender,” Ripple’s press release pulled no punches, referring to the agency’s “absurd theatrics.” Interestingly, following this update, the value of XRP experienced an increase, reaching $0.51, representing a 4.1% rise.

SEC’s Ongoing Struggle with Crypto Regulation

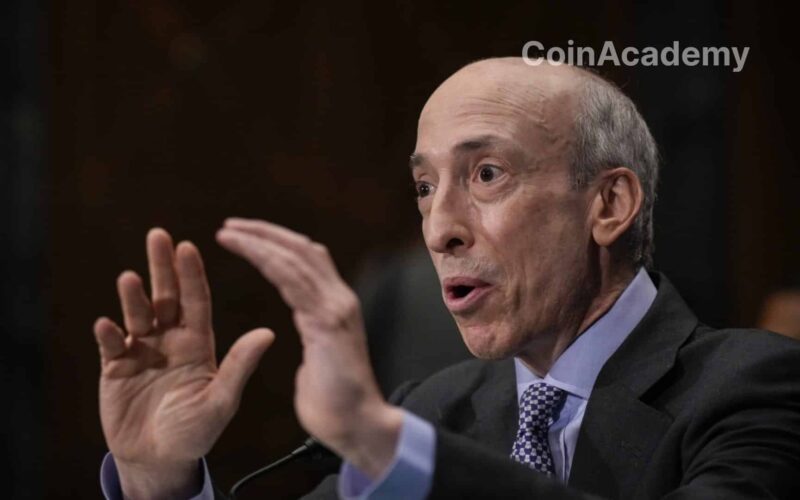

The overall narrative shows that the SEC has faced repeated setbacks in its pursuit of crypto entities accused of securities law violations. Despite SEC Chairman Gary Gensler’s firm belief that the majority of cryptocurrencies should be considered securities under the agency’s jurisdiction, several US court rulings have highlighted the complexity of the matter.

With a legislative void surrounding cryptocurrency regulation, these legal battles could very well shape the framework of the US government’s stance on digital assets. In the meantime, Ripple has shifted its focus internationally, with nearly 90% of its operations now conducted outside the United States.

Katherine Kirkpatrick Bos, Chief Legal Officer at Cboe Digital, suggests that the dismissal of individual cases could be a tactical move by the SEC. She suggests that it could allow for an expedited appeals process for the Ripple verdict.