In 2020, the SEC proposed that Ripple publicly acknowledge that XRP was a security. Ripple contested this offer, arguing that XRP is not a security. The SEC has not established a clear regulatory framework for cryptocurrency compliance.

SEC’s Proposed Settlement Offer to Ripple Before the Lawsuit

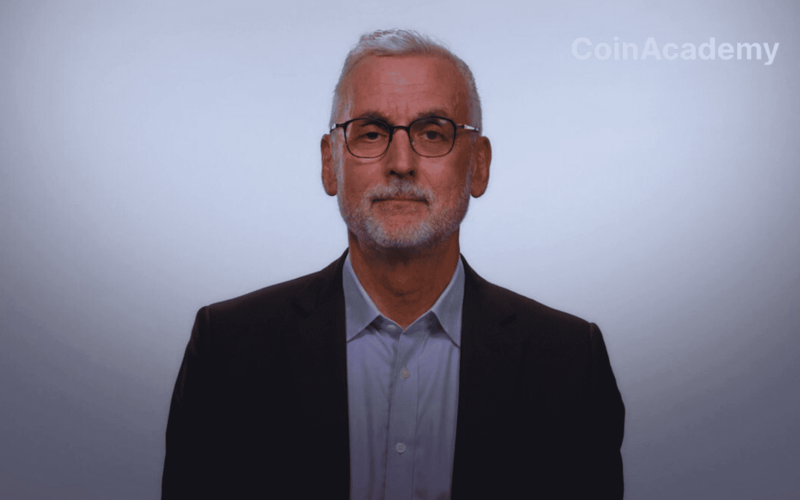

Ripple’s General Counsel, Stuart Alderoty, has just revealed the details of the settlement offer made by the SEC before initiating a lawsuit against Ripple in December 2020.

According to Alderoty, the SEC suggested that Ripple publicly declare that XRP was a security. This proposal also provided a brief period for the market to comply with regulatory requirements. However, Ripple disputed this request, asserting that XRP is not a security.

The company also criticized the SEC for not establishing a clear regulatory framework for cryptocurrencies, despite industry criticism and the relocation of some companies outside the United States.

The Evolution of a Landmark Lawsuit

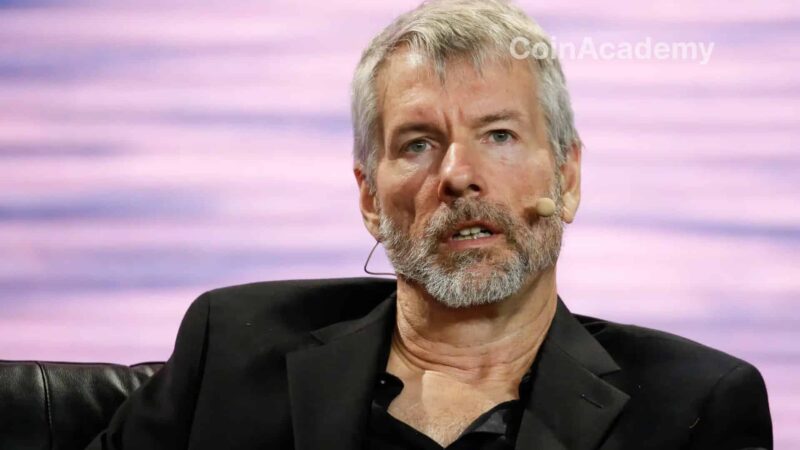

Finally, the SEC filed a lawsuit against Ripple’s co-founders, Christian Larsen and Bradley Garlinghouse, accusing them of conducting an unregistered digital securities offering that raised over $1.3 billion.

However, in July 2023, Judge Analisa Torres ruled that XRP is not a security in retail transactions.

In October, the SEC dropped the charges against Garlinghouse and Larsen.

This case has highlighted the regulatory challenges faced by cryptocurrency firms in the United States and the need for a much more suitable framework.