Norway’s Sovereign Wealth Fund Indirectly Exposed to Bitcoin via MicroStrategy

The indirect exposure of Norway’s sovereign wealth fund to Bitcoin has increased by 153% in one year, reaching 3,821 BTC (approximately $400 million) as of December 31, 2024, according to K33 analyst, Vetle Lunde. This increase is mainly due to investments made by Norges Bank Investment Management (NBIM) in several cryptocurrency-related companies, including MicroStrategy, Riot Platforms, Marathon Digital Holdings (MARA), Coinbase, Canaan, and Metaplanet.

An Indirect Exposition Rather Than a Strategic Choice

This increase in exposure does not stem from a deliberate choice by the fund in favor of Bitcoin, but rather from automated sector weighting, explains Vetle Lunde. By investing in companies holding Bitcoin in their treasury, NBIM is unintentionally acquiring growing exposure to this asset. This phenomenon illustrates how Bitcoin is gradually making its way into the portfolios of large institutional investors, sometimes without a direct intention.

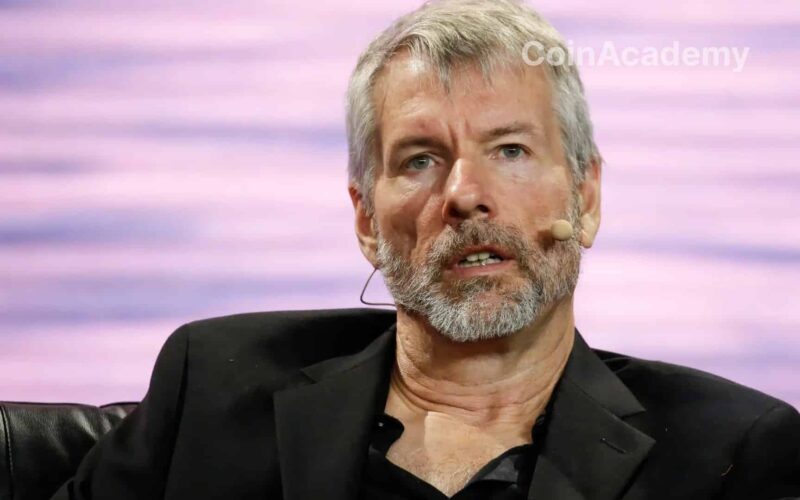

MicroStrategy Leading the Fund’s Bitcoin Assets

NBIM’s most significant investment in Bitcoin is made through MicroStrategy, a market leader in digital asset holdings. NBIM holds 0.72% of the company’s shares, estimated at $514 million as of the end of 2024. This position represents indirect exposure to 3,214 BTC, which accounts for nearly 85% of the total held by the fund.

An Expanded and Diversified Crypto Portfolio

In addition to MicroStrategy, NBIM also holds significant stakes in other companies with direct exposure to Bitcoin, including:

- 0.71% of Marathon Digital Holdings (MARA), equivalent to 315 BTC

- 0.85% of Coinbase, representing 80.6 BTC

- 0.44% of Riot Platforms, corresponding to 76.7 BTC

- 1.1% of Tesla, which amounts to 106.9 BTC

The addition of Metaplanet, a lesser-known but highly exposed player in the cryptocurrency space, demonstrates a growing interest in companies diversifying their balance sheets with digital assets.

A Phenomenon Reflecting Market Maturity

The phenomenon of Norway’s sovereign wealth fund’s indirect exposure is indicative of Bitcoin’s growing presence in traditional financial markets. NBIM’s exposure to Bitcoin has increased from $23 million in 2020 to $356 million in 2024, reflecting gradual institutional adoption.

On average, each Norwegian citizen now holds 68,837 satoshis (approximately $64) through the sovereign fund, illustrating the exponential growth of digital assets in long-term investment strategies.