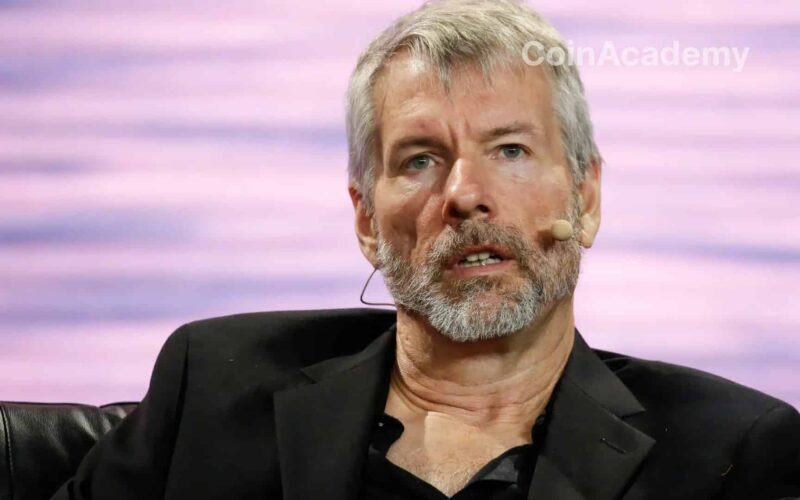

Michael Saylor Announces a New Strategy for MicroStrategy: Raising $42 Billion in 3 Years to Buy Bitcoin

MicroStrategy, the Bitcoin investment company led by Michael Saylor, is embarking on an ambitious financing strategy: raising $42 billion over three years to acquire more Bitcoin. This project, dubbed the ’21/21 Plan,’ is based on a dual fundraising approach: $21 billion through equity issuance and $21 billion through debt. This colossal sum demonstrates Saylor’s unwavering commitment to Bitcoin, which he considers a crucial asset for the company’s treasury reserves.

Current Reserves and the Quest for Optimized Returns

MicroStrategy, already holding 252,220 bitcoins acquired for a total of $9.9 billion, has ambitions that go beyond its role as a listed company. Each bitcoin in its portfolio has an average cost of $39,266, and with the current price surge to around $72,000, the value of these assets now exceeds $18 billion. In a context of stable liquidity and increasing Bitcoin transactions, the company aims for even higher performance in its BTC portfolio, with a target yield ranging from 6% to 10%, compared to the previous range of 4% to 8%.

Phong Le, CEO of MicroStrategy, emphasized the importance of this yield as a key performance indicator (KPI) for the company. The latest quarterly report shows a return of 17.8% for the third quarter, well above the target range, further bolstering the company’s confidence in its ability to maximize its Bitcoin investments.

Goals Aligned with the Evolution of the Crypto Market

MicroStrategy’s determination comes at a favorable time for Bitcoin, with a notable increase in liquidity in stablecoins and a growth in transactions on the network. These factors contribute to an ‘Uptober’ in the crypto ecosystem, a popular term for a month of bullish performance driven by strong institutional demand and robust market fundamentals. MicroStrategy seems to be capitalizing on this trend to justify its ’21/21 Plan’ and aims to establish an even more strategic position in the market through this initiative.

MicroStrategy: Perspectives of Bitcoin-Centric Treasury Management

With this new phase of fundraising, MicroStrategy is not only investing in Bitcoin: it is redefining the contours of treasury management for listed companies by treating this digital asset as a strategic reserve. Saylor’s model is based on the conviction that Bitcoin is a long-term anti-inflation asset, safer than traditional liquidity options. The firm has nearly $900 million from a previous fundraising round in reserve to support its acquisition strategy.

Despite a 10% drop in its post-market shares following the announcement, MicroStrategy remains up 250% for the year, a sign of continued investor confidence in this unconventional approach. With this financing plan, the company could further strengthen its dominance as a major player in the Bitcoin landscape.