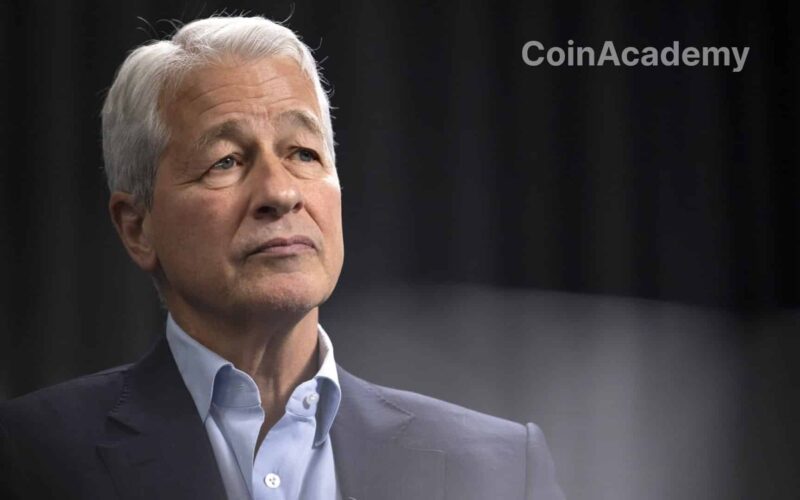

JPMorgan, through its financial analysts, has expressed concerns about the sustainability of the capital inflows observed in Bitcoin Spot ETFs earlier this year. According to them, the current high level of Bitcoin prices raises doubts about the continuity of these investments.

Given the high level of Bitcoin prices compared to its production cost or compared to gold, we doubt that the pace of $12 billion recorded since the beginning of the year will continue until the end of the year.

Analysis of Inflows into Cryptocurrencies

Since the beginning of the year, the cryptocurrency market has seen significant financial flows, primarily through Bitcoin ETFs, attracting up to $16 billion in investments.

However, JPMorgan analysts, led by Nikolaos Panigirtzoglou, believe that the sustainability of this trend for the rest of the year remains uncertain. They add that, by incorporating flow impulses from CME futures contracts and funding by crypto-specialized venture capital funds, the total inflows amount to $25 billion.

Reevaluation of Net Inflows

The analysts point out that these figures do not necessarily represent new funds entering the market. Many investors have likely transferred funds from crypto wallets on exchanges to Bitcoin ETFs, driven by cost, liquidity, and regulatory advantages.

This transfer is supported by a decrease in Bitcoin reserves on exchange platforms, which have decreased by 220,000 BTC, or about $13 billion since the ETFs were launched in January. With adjustments, JPMorgan estimates that net inflows into crypto assets amount to approximately $12 billion since the beginning of the year.

The analysts predict that if the current trend continues, it could result in an annual net inflow of about $26 billion into cryptocurrencies. However, given the high level of Bitcoin prices compared to its production cost and relative value to gold, they remain skeptical about the sustainability of this investment pace.