FTX Sells $1 Billion Worth of Grayscale Bitcoin Trust (GBTC) Shares

FTX has sold approximately $1 billion worth of shares in the Grayscale Bitcoin Trust (GBTC), contributing to a significant outflow of funds.

Sale by FTX Coincides with Bitcoin Price Drop Since ETF Approval

FTX’s sale coincided with a decline in the price of Bitcoin following the approval of Bitcoin ETFs. Spot

FTX Invested in GBTC to Capitalize on the Price Difference

The cryptocurrency market has seen a significant sale of shares in the Grayscale Bitcoin Trust (GBTC) since its conversion to an exchange-traded fund (ETF) earlier this month. A large portion of this outflow is attributed to the sale of 22 million shares (approximately $1 billion) by FTX, significantly reducing its stake in GBTC.

Details of the GBTC Sale by FTX

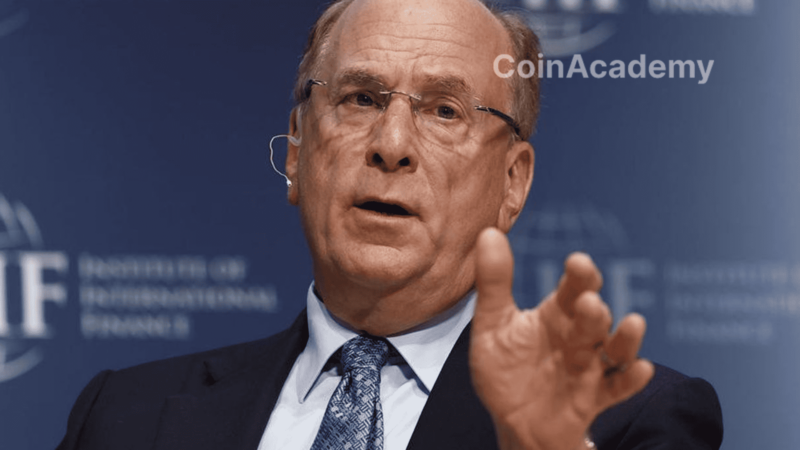

The sale by FTX, estimated to be close to $1 billion, has been identified as a major cause of the outflows observed in GBTC. Data indicates that this sale has reduced FTX’s stake in GBTC to zero. This action comes at a time when several new Spot Bitcoin ETFs, issued by companies such as BlackRock and Fidelity, have seen inflows, while GBTC has experienced significant outflows.

Market Effects: Is FTX Responsible for the Bitcoin Drop?

The impact of FTX’s sale on the price of Bitcoin has been notable, with the price declining since the SEC’s approval of Bitcoin ETFs. However, with the end of the sale of FTX’s holdings, selling pressure could ease, as the liquidation by a bankrupt entity is a relatively unique event in the market.

FTX had adopted a strategy to capitalize on the price difference between GBTC shares and the net asset value of the underlying assets (BTC). The value of GBTC shares held by FTX had risen to over $900 million, based on the first day of trading of Grayscale’s Spot Bitcoin ETF on NYSE Arca.