The historic fall of the Terra ecosystem is not without mystery. One of these mysteries lies in the use of Bitcoins held by the Luna Foundation Guard (LFG). Elliptic, a company that specialises in blockchain data analysis, has looked into the matter to shed light on the mystery.

As a reminder, the LFG has been accumulating bitcoins for several months to serve as a reserve for the UST. Indeed, as a precautionary measure, the LFG wanted to guarantee its stable coin other than by the algorithmic mechanism based on supply and demand. Thus, the interest of this bitcoin reserve is to provide a back-up solution to maintain the UST peg to the dollar.

So far, this reserve has not had the desired effect. As a result, many investors distraught at the loss of money have questioned the future of the 80,394 bitcoins purchased by the LFG between January and May 2022.

Elliptic demonstrates the transfer of bitcoins held by the LFG

Elliptic’s investigation proves that these bitcoins were indeed moved. Indeed, on 9 May, the LFG announced that it was lending the equivalent of $750 million of BTC to OTC trading companies to help protect the UST’s peg to the dollar. Indeed, it was through one of these firms that LFG acquired its bitcoins before the UST depeg.

The purpose of going through these companies was to offer the trader the opportunity to trade this money in the market to help protect the UST peg and to be able to accumulate Bitcoin under normal market conditions. This decision was made by LFG to warn of a potential continuation of the volatility that has been present for several days on UST and LUNA.

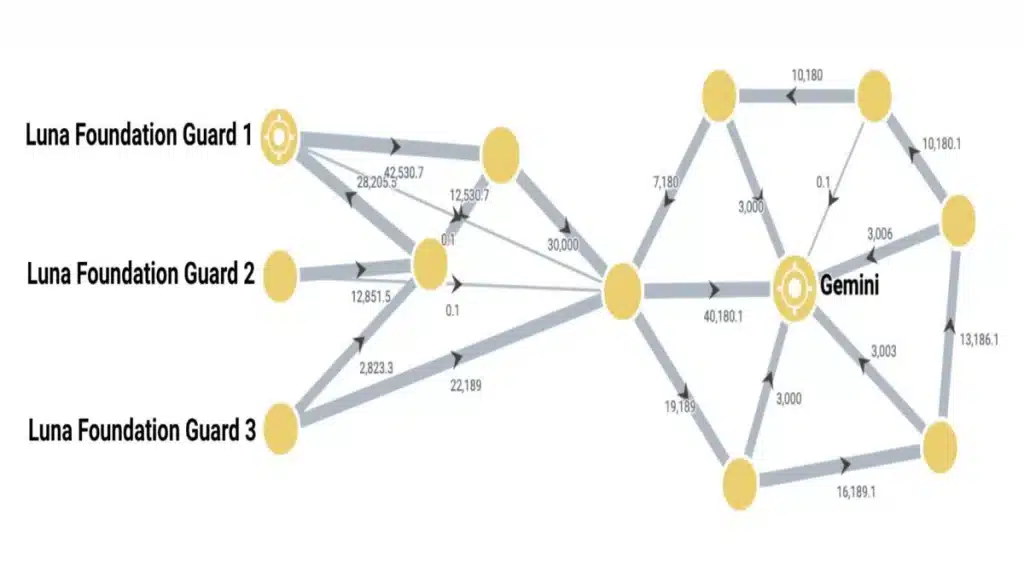

At the same time as this statement was made, 22,289 bitcoins equivalent to $750 million were sent from a bitcoin address held by the Luna Foundation to a new address. Later that day, another 30,000 bitcoins will be sent to this address. Finally, all of these bitcoins were sent to an account held on Gemini (a crypto-currency exchange).

As a result of these transactions, LFG’s bitcoin reserves are down to 28,205 bitcoins. On 10 May, the foundation decided to transfer all remaining bitcoins to a Binance account.

The use of bitcoins seems opaque

The major consequence of transferring these bitcoins to accounts on centralised crypto-currency exchanges is to keep their use unclear. Indeed, for both Gemini and Binance, it is almost impossible to trace bitcoins once they have been deposited on the exchanges.

Tom Robinson, one of the founders of Elliptic, explains “they can’t really know how these bitcoins were used. They may have been sold, they may have been stored on the exchanges or worse they may have been withdrawn again and sent to a new wallet”.

There may be little hope left for aggrieved UST and Luna users. If these bitcoins are still in the possession of the LFG, they could potentially be used to partially compensate for the losses incurred. However, this may be difficult to implement in practice, although Do Kwon’s recent statement would support compensation.