The Ethereum network (ETH) is about to undergo a major update, aiming to change the consensus system. This was announced in the early years of Ethereum, by its co-founder Vitalik Buterin. Thus, the blockchain is about to move from proof of work to proof of stake. This transition will lead to a replacement of miners by so-called validator nodes.

However, this transition could be jeopardized by the lack of diversity in the Ethereum clients used.

The problem of client diversification on Ethereum in Proof of Stake

The problem of diversifying clients on Ethereum into Proof of SEthereum is a decentralized blockchain, which operates through thousands of nodes with the mission of verifying the blocks as well as the transaction data. To do this, each node operates a specialized software, called a client.

Whether in its proof of work (POW) or proof of stake (POS) version, Ethereum relies on several clients, each with its own implementation. We can mention Geth, Prysm, Lighthouse or Teku.

Unfortunately, the Ethereum beacon chain, i.e. the blockchain that ensures the consensus in proof of stake launched in December 2020, presents a real problem of diversification of clients.

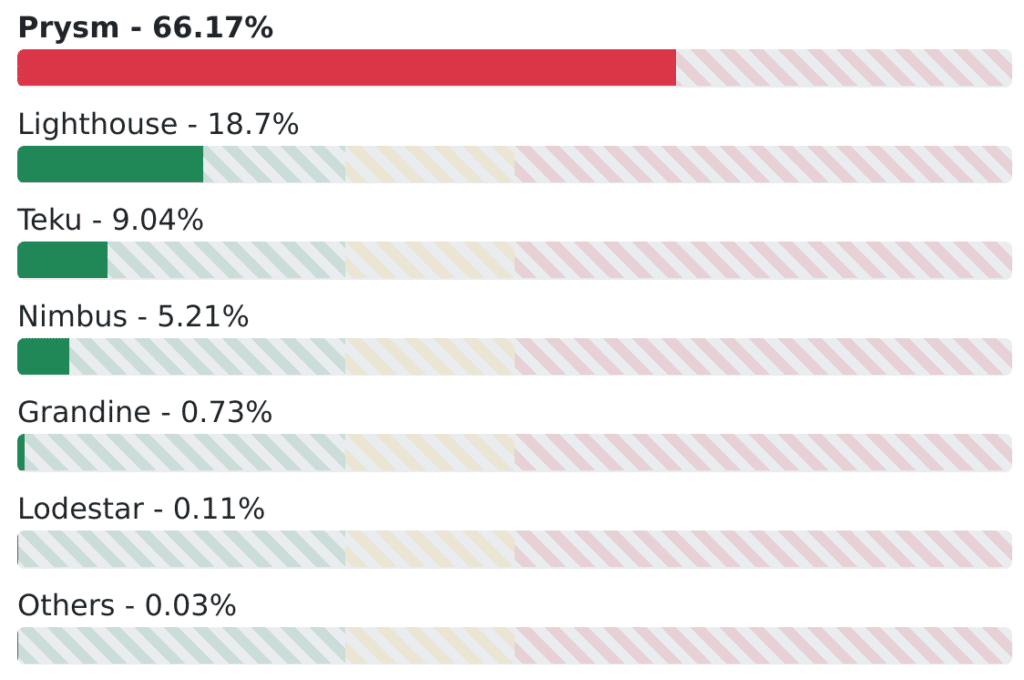

Thus, more than 66% of the nodes in the network operate the same client, namely Prysm. take

The current version of Ethereum in proof of work faces the same problem. Indeed, it is largely centralized around the Geth client software.

The risks inherent in the lack of diversification

For several months now, various players in the Ethereum ecosystem have been sounding the alarm about the problem of customer diversification.

“If a single client is used by 2/3 (66%) of validators (which is currently the case), there is a very real risk that this will lead to chain disruption and financial losses for node operators.”

Explains the site clientdiversity.org.

Indeed, this dependence on Prysm could well have important repercussions on the whole ecosystem.

For example, if Prysm were to encounter a bug, it could lead to a total paralysis of the network, as more than 2/3 of the nodes could potentially go offline or worse, generate a wild fork of the chain.

“”It takes 2/3 of the validators to achieve finality. If a customer with over 66% market share has a bug and forks to their own chain, they will be able to finalize. Once the fork is finalized, the validators cannot return to the real chain without being cut off. If 66% of the chain is forked simultaneously, the penalty is the full 32 ETH.”

Continues clientdiversity.

Coinbase and Kraken: the bad pupils of Ethereum

On Sunday, February 20, @superphiz once again warned the community about the diversification problem.

Thus, he reminds us that this problem is mainly caused by the main staking pools, namely those of Coinbase and Kraken.

Indeed, between them, these two entities host the nodes of 78,000 validators out of a total of 296,000 validators on the network.

Unfortunately, they both use the Prysm client for the vast majority of their nodes. As a result, they are both active participants in the lack of client diversity.

Kraken and Coinbase finally react

Faced with this massive awareness campaign around customer diversification, Coinbase and Kraken had no choice but to evolve their system.

Thus, Kraken was the first entity to respond to @superphiz, the day after its publication. It announced that it was exploring the use of several clients, fully aware of the risk generated by the lack of diversification.

“We can confirm that we are exploring other clients to diversify. We will not completely abandon Prysm Labs but rest assured that our developers are looking to diversify 😉.”

Kraken said on Twitter.

The next day, it was Coinbase’s turn to address the issue. Thus, the exchange platform announced to work on a greater diversification of customers. A process that, it would seem, is already underway.

Indeed, Coinbase announced that about 24% of their validators operate another client than Prysm.

News that will delight users. However, as @superphiz pointed out in his response to Kraken, Kraken will only stop lobbying when we get on-chain evidence of the announcements made by Kraken and Coinbase.

This diversification is essential for the smooth deployment of The Merge. As a reminder, The Merge aims to merge Ethereum’s execution layer, namely the application ecosystem, DeFi, NFTs, etc, with the proof-of-stake consensus layer managed by the beacon chain.

The Ethereum network should transition to proof of stake around June via The Merge. However, this transition could well prove to be more complex in the context of the hegemony of one client over the others.