Coinbase is reportedly in advanced negotiations to acquire CoinDCX, the leading Indian crypto platform. The rumored acquisition price is less than one billion dollars, a significant drop from its 2021 valuation of 2.2 billion.

However, CoinDCX CEO, Sumit Gupta, swiftly denied the sale, asserting a commitment to remaining independent and focused on the Indian market.

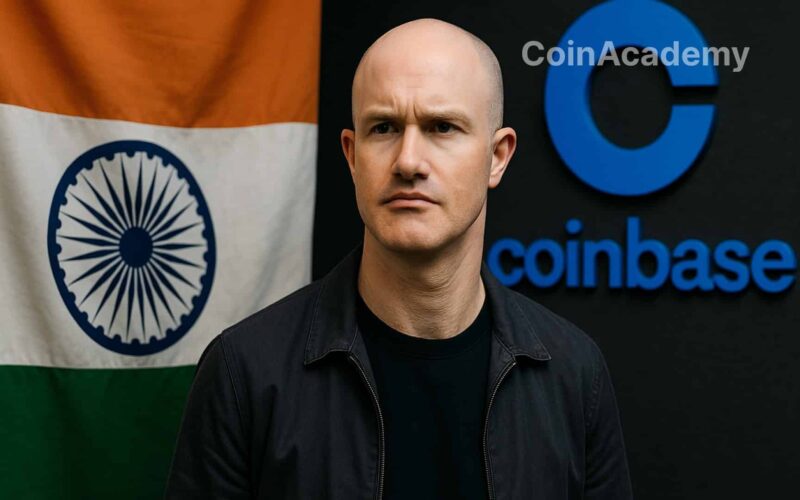

Coinbase in Advanced Negotiations to Acquire CoinDCX

The news of Coinbase’s potential acquisition of CoinDCX has been circulating since this morning, with a speculated amount of less than one billion dollars, a steep decline for a company valued at 2.2 billion in 2021.

A Rumor, a Tweet, and the End of Suspense?

According to local media Mint, Coinbase has approached CoinDCX for an acquisition, aiming to establish a presence in the dynamic and intricate Indian crypto market.

The response from Gupta on Twitter was unequivocal, affirming CoinDCX’s focus on India and dismissing the rumors.

The timing of these negotiations comes amidst recent challenges, including a $44 million hack on an operational wallet. Despite no customer funds being affected, the incident has dented the company’s reputation.

Less Than a Billion: A Sign of Weakness?

The notable detail that has stirred the markets is the speculated valuation. A purchase price of less than a billion would signify a halving of CoinDCX’s 2021 valuation amid regulatory pressures and competition with CoinSwitch and foreign platforms.

Notably, Coinbase already holds stakes in CoinDCX and CoinSwitch, making the prospect of a complete acquisition feasible. However, Coinbase has maintained its silence regarding these rumors.

India Remains a Hot Target

With a highly connected population, growing crypto enthusiasm, and a government alternating between repression and innovation, India remains a key market for the next wave of adoption.

CoinDCX aims to position itself as the local champion despite challenges, with Sumit Gupta emphasizing organic growth, domestic market focus, and strategic independence.

The message is clear: there is no intention to sell at a discounted price.