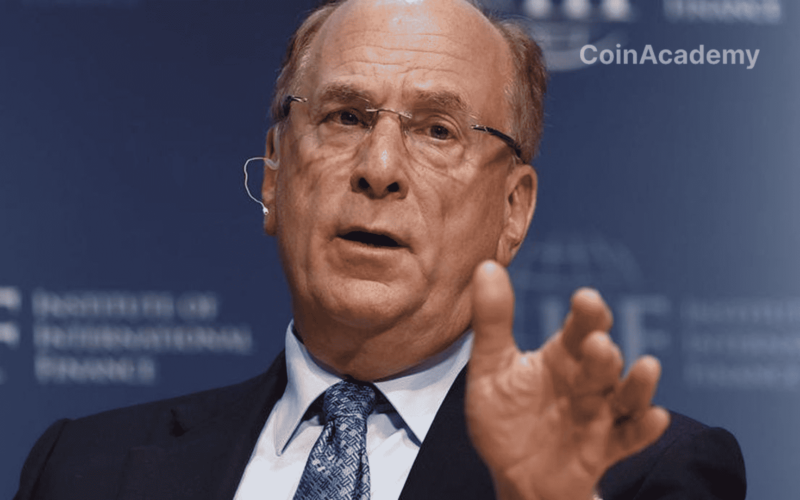

BlackRock Plans to Launch ETF Spot on ETH, Awaits Regulatory Approval

BlackRock, the global asset management leader, has shown its intention to launch an Exchange Traded Fund (ETF) holding ETH, the cryptocurrency of Ethereum. This initiative signifies BlackRock’s deepening engagement with the digital asset space and highlights the growing adoption of crypto by institutional investors.

Following the announcement, the price of Ether experienced a surge, surpassing $2,100, indicating a positive market reaction to BlackRock’s potential entry into the Ethereum space.

Custody Strategy and Market Surveillance

BlackRock’s application for the Ethereum ETF will be listed on Nasdaq, subject to regulatory approval. Coinbase has been selected as the custodian for the Ether held by the product, while an undisclosed third party will manage the fiat. A market surveillance partnership with Coinbase has also been established, a crucial element for SEC approval of such ETFs, as seen with Bitcoin Spot ETF applications.

BlackRock appears to anticipate potential objections from the SEC regarding market surveillance, stating that Ether futures prices from the CME Group closely align with the spot prices of ETH. The approval of this Ethereum ETF could thus mark a decisive turning point for the accessibility of cryptocurrencies to a wider audience.