Observations of the Fintech Snark Tank

President Biden’s recent executive order regarding the responsible development of digital assets has helped drive up the price of Bitcoin, Ethereum and other crypto-currencies. According to Ari Redford, head of legal and government affairs at TRM Labs:

“The executive order is really a call for coordination – playing quarterback to ensure that regulators work together to fuel a clear and consistent framework for crypto regulation rather than engaging in disparate workflows.”

The White House resident’s executive order aims to familiarize banks with the crypto ecosystem and allow their customers to obtain crypto through the traditional banking system. This seems to make sense as long as centralized exchanges, entities that reassure traditional investors and individuals who want to acquire Bitcoin and cryptocurrencies as simply as possible.

Americans want crypto from their banks

Ron Shelvin, head of research at Cornerstone Advisors, deciphers a February 2022 survey of U.S. consumers on the topic of cryptocurrencies. He finds that one in five U.S. adults hold some form of crypto-currency. Obviously, there are wide variations between generations:

- A quarter of Gen Z (ages 21 to 26) are crypto investors, and nearly three in 10 plan to invest in 2022.

- Among Millennials (27 to 41), 30% have already invested in crypto, and 27% plan to do so this year.

- Among Gen Z and Millennials in crypto, 40% bought or sold it five or more times in 2021.

Governments and legislative powers are busy regulating crypto-assets to engage in the crypto revolution, The regulatory measures that are at work, between Biden’s executive order in the United States or the MiCa bill (which has just been rejected by the European deputies) demonstrate the political and financial stakes of the crypto revolution.

Banks, like centralized exchanges, are institutions that inspire the trust of individuals and traditional investors, and will likely be indispensable players for the democratization and mass adoption of crypto-currencies and blockchain.

Among Americans who already hold Bitcoin or other crypto-currencies, more than half said they would definitely use a bank to invest in crypto if they could, with an additional 42 percent indicating that they might.

Banks are reluctant to get involved in cryptos, a risk aversion?

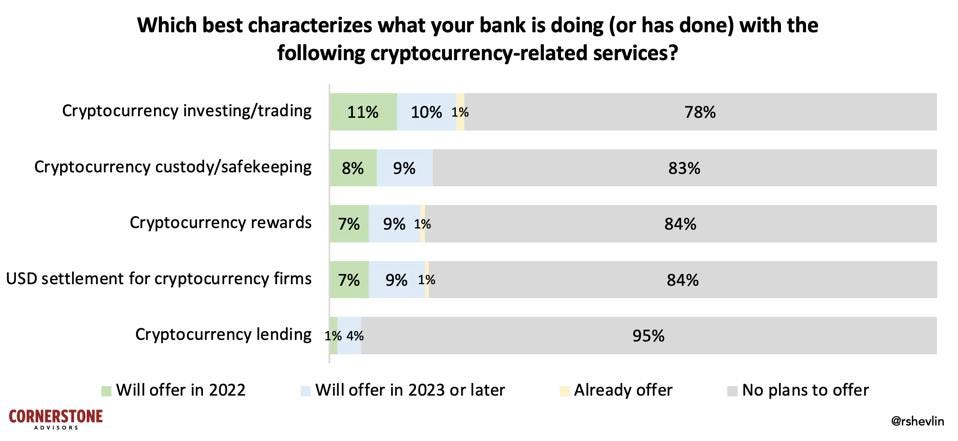

According to Cornerstone Advisors’ What’s Going On in Banking 2022 study, only 1% of U.S. banks were providing crypto-currency financial services, prior to this year. Going forward, about one in 10 plan to offer these services in 2022, with an almost similar percentage planning to offer crypto storage or rewards services.

While regulators have received positive advice on crypto activities in 2021, there are crypto-skeptics among bank executives. One senior bank executive told Cornerstone:

“Why are there more crypto-currencies than U.S. banks and credit unions combined? When is consolidation and spillover going to happen?”

Another commented:

“[Crypto-currencies] are not stable enough to be a legitimate payment mechanism, as the value can fluctuate during the transaction. Instead of pushing crypto ATMs and ways to create your own currencies, it would be great to focus more on how to solve problems like unaffordable housing and student loans.

There will of course be crypto-skeptics among some bank executives, and there’s no point in trying to convince them, history will do that. But fortunately, others are already anticipating the impact of the crypto revolution, as another executive more savvy on the issue noted:

“We need to accept that crypto currency is here and start planning TODAY on how to deal with it and not wait until it’s too late and we react rather than plan.”

Bitcoin, the next banking revolution

As Ron Shelvin mentions, in his Forbes article, banks have a long list of reasons to avoid crypto-currency: “consumers shouldn’t invest in it”, “too many regulatory issues”, “it’s too risky”, etc.

The biggest risk for banks is not providing crypto-currency services.

Patrick Sells, chief innovation officer at NYDIG , which partners with leading bank core system providers to integrate crypto services, says:

“By not offering crypto-currency trading services, banks potentially have greater exposure to anti-money laundering because they don’t know where incoming funds are coming from.”

Banks need to monitor where the funds being transferred are coming from and contrary to popular belief, Bitcoin and crypto-currencies in general are easily traceable, thanks to the digital ledger that is the blockchain and the hash of transactions. Etherscan is a tool that is used to track transactions on the Ethereum blockchain for example, and one can imagine that many applications are to come to meet this demand.

In January and February 2022, more money moved from banks to crypto platforms like Coinbase than to Amazon, Walmart and Target combined.

Chris Nichols, director of capital markets at South State Bank, advises banks to set thresholds when offering crypto services and answer the following questions:

- Will your bank offer a crypto product when X number of banks offer it?

- Will the bank offer crypto when it sees Y amount of dollars come out?

- Will the bank offer crypto when it can get a Z% ROI on the effort?

In an April 2021 article on Fintech Snark Tank titled The Coming Bank-Bitcoin Boom, Ron Shevlin predicts that four forces would mobilize the banking industry to provide crypto services in 2022:

- Major institutions launch crypto offerings;

- PayPal and Square’s success in the crypto space;

- Strong consumer interest and demand; and

- Continued regulatory easing and guidance.

Biden’s executive order paves the way for this Bitcoin banking boom in 2022, the United States intends to become the forerunner of Web3, mirroring its hegemony over the digital world today.