BlackRock, the investment management giant, has launched a tokenized assets fund, as per a recent filing with the United States Securities and Exchange Commission (SEC).

BlackRock ventures into tokenization

According to the SEC filing, the BlackRock USD Institutional Digital Liquidity Fund, based in the British Virgin Islands, signifies BlackRock’s official entry into the tokenization space.

This fund, established in partnership with tokenization firm Securitize, was initialized with $100 million in USDC stablecoin on the Ethereum network. This move by BlackRock follows its recent foray into digital asset funds with the launch of a Bitcoin Spot ETF in January, quickly amassing over $15 billion in assets under management.

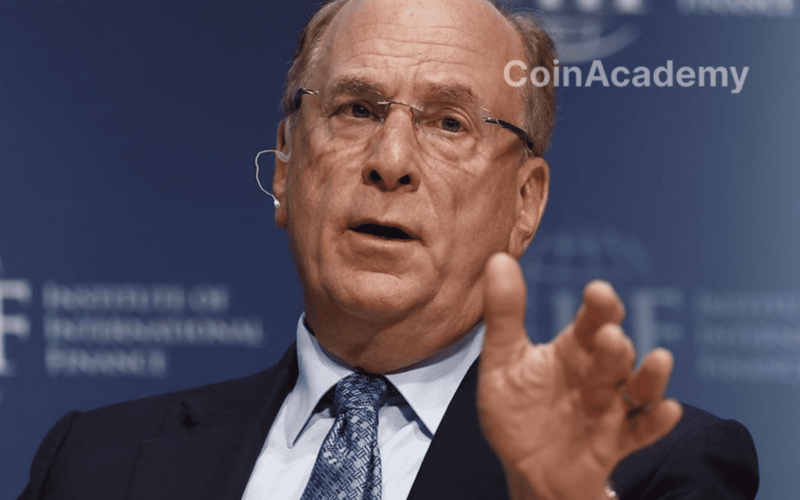

A tokenized future according to Larry Fink

Larry Fink, CEO of BlackRock, expressed in January during an interview with CNBC his belief that BTC and ETH-based ETFs are just the precursors of a broader era of tokenization.

“I really think this is where we are headed,” he stated, envisioning a future where tokenizing real assets could revolutionize traditional finance by providing faster settlements and increased efficiency.

Impact on the tokenization sector

BlackRock’s launch of this fund marks a significant milestone for tokenizing real-world assets, a rapidly growing sector at the intersection of digital assets and traditional finance. The market response was immediate, with a significant rise in the native token of tokenization platform RWA Ondo Finance, ONDO, which saw its price increase by 20% following the announcement.