BlackRock Sets New Record with $10.5 Trillion in Assets Under Management

BlackRock has reported its financial results for the first quarter of 2024, revealing an impressive record of $10.5 trillion in assets under management (AUM), an increase of $1.4 trillion from 2023.

This remarkable performance reflects an increase in non-operating income and a lower effective tax rate during the current quarter. The diluted earnings per share for the company also increased from $7.9 million in the first quarter of 2023 to $9.81 million in the first quarter of 2024, with net income increasing by $1.2 billion to approximately $1.5 billion.

Strategic Expansion and Acquisitions

As part of its expansion strategy, BlackRock has issued $3 billion in debt to partially finance the cash consideration for the planned acquisition of Global Infrastructure Partners (GIP), an infrastructure investment fund focused on equity investments and certain debts.

This acquisition, announced during the fourth quarter 2023 earnings report, aims to create a new infrastructure investment platform, demonstrating BlackRock’s ambition to strengthen its presence in this sector.

Capital Inflows and Growth Outlook

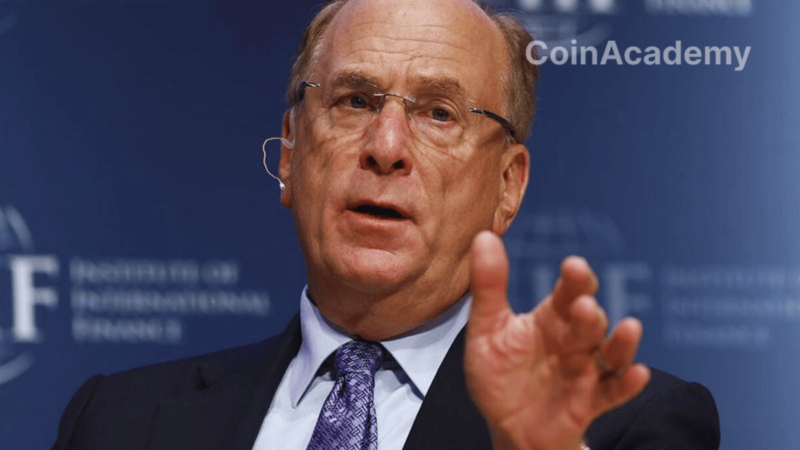

The quarter also saw BlackRock manage $76 billion in new long-term net inflows, representing nearly 40% of full-year 2023 levels. BlackRock CEO, Larry Fink, highlighted the company’s growing momentum, with accelerated client activity and clear financing prospects for significant wealth and institutional management mandates.

Larry Fink also emphasized the significant growth potential for the company in the infrastructure, technology, retirement, and comprehensive portfolio solutions sectors.

BlackRock and the Crypto Industry

As a major player in the crypto industry, BlackRock manages one of the world’s largest Bitcoin Spot ETFs, the iShares Bitcoin Trust (IBIT). Since its launch in January 2024, IBIT has accumulated 266,580 BTC, valued at $18.5 billion.

Larry Fink, now known in the crypto community as a staunch Bitcoin supporter, reaffirmed in March 2024 his optimism about the long-term success of Bitcoin, especially with IBIT’s rapid growth, which he describes as the fastest-growing exchange-traded fund in history.