A trader known as JustWakingUp has placed a $15,000 bet on a 50 basis point decrease in the Fed’s rates, against almost unanimous consensus for -25 bps, with a potential gain of $226,000 if successful.

This Polymarket veteran, with $400 million in volume and over $2 million in profits, is already benefiting from unrealized gains and could make one of the most significant bets in the platform’s history.

The historic revision in American employment (-911,000 jobs) coupled with weak inflation figures fuels the hypothesis of a more aggressive Fed decision to support the economy.

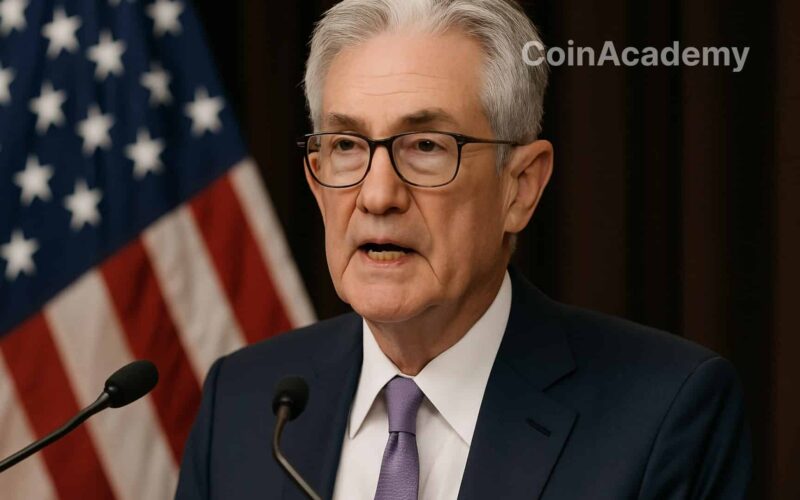

A 0.5% Fed rate cut possible?

A Polymarket star trader, known as JustWakingUp, is betting big on a scenario that Wall Street deems unlikely: a 50 basis point decrease in the Federal Reserve rates next week. While the consensus points to a more modest reduction of 25 basis points, the investor has staked $15,000 on this bold bet. If the Fed surprises, his potential gain will reach $226,000.

A veteran of decentralized betting

JustWakingUp is no ordinary player. He is simply the most active trader on Polymarket, with nearly $400 million in cumulative volume and over $2 million in profits already earned. Suffice it to say, his intuition is catching the markets’ attention.

His position is already starting to pay off: an unrealized gain of 3% is visible on the ticket. If successful, he would make one of the most significant moves in the platform’s history, solidifying Polymarket’s image as an alternative barometer of economic expectations.

Consensus says “25 bps”

For now, the market largely remains stuck on the idea of a 25 basis point cut, with a 91% probability according to the CME FedWatch Tool. However, the scenario of a more aggressive reduction has gained traction in recent days: the chances of a 50 basis point cut have risen to nearly 10%, boosted by weak employment figures in August.

Even giants like BlackRock or Standard Chartered have opened the door to this hypothesis, suggesting that a strong signal from the Fed may be necessary to reignite a slowing economy.

The shadow of revised figures

The context favors bold bettors. The Bureau of Labor Statistics revealed on Tuesday that the U.S. had actually created 911,000 fewer jobs than expected between March 2024 and March 2025. It’s the biggest downward revision in history, radically altering the outlook of the American labor market.

These data weaken the argument of a “resilient” economy and strengthen the case for the Fed to act decisively to prevent a sharp slowdown.

Eyes on inflation

The game is not over yet. Investors eagerly await the upcoming statistics: this Wednesday’s Producer Price Index (PPI) turned out lower than expected and Thursday will reveal the Consumer Price Index (CPI). Weaker-than-expected figures could boost the advocates of a 50 bps cut, while sending bitcoin and stock markets higher.

JustWakingUp’s bet is risky, but it perfectly illustrates the current climate: a wavering American economy, escalating expectations, and a Fed facing a significant dilemma. Next week could reshuffle the deck, not just on Polymarket.