The US-listed Ethereum ETFs recorded a record $726 million in inflows in a single day, triggering an immediate +8% surge in the ETH price.

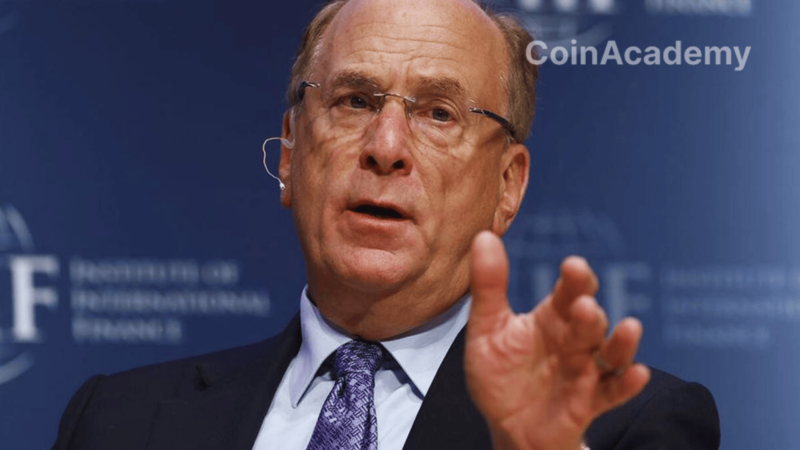

Leading the charge, BlackRock, Fidelity, and Grayscale amassed over $667 million collectively, bolstering institutional interest in Ethereum.

A new trend is emerging with ‘Digital Asset Treasuries’: companies accumulating ETH to use as collateral or a productive asset, signaling a structural shift in demand.

BlackRock, Fidelity, Grayscale: Heavy-Hitters Are In

Wall Street has lit the fuse. On Wednesday, July 16, US-listed Ethereum ETFs saw $726.74 million in net inflows in a single day. Unprecedented. ETH immediately surged over 8% to surpass $3,475, delivering its best daily performance since March 2025.

At the forefront, the giant BlackRock and its ETHA ETF attracted nearly $500 million alone, with $1.78 billion in traded volume. Right behind, Fidelity and Grayscale captured $167 million combined, confirming the overall excitement surrounding the asset.

Raw Numbers Conceal a Much Deeper Trend

Since their launch, Ethereum ETFs have now accumulated $6.48 billion in inflows. Their assets under management exceed $16.41 billion, approximately 4% of ETH’s total market cap.

But beyond the numbers, it’s the profile of the buyers that intrigues analysts. According to Ben Lilly of JLabs Digital, a new trend is emerging: Digital Asset Treasuries (DATs).

It’s a recent yet massive phenomenon: investment funds and companies accumulating ETH not for speculation but to use as collateral, a source of yield, or a means of payment.

There are hundreds of millions of dollars in ETH demand that simply did not exist before. It’s no longer just a flow effect. It’s a structural change.

ETH Evolves into a Full-Fledged Productive Asset

This shift is reflected in another key indicator: the Moneyness Ratio, which measures the portion of ETH used productively (staking, DeFi, etc.). Historically high, this ratio indicates an increased use of ETH as a working asset, not just a speculative reserve.

Today, the ETH network demand hovers around $2 million per day. But projections are clear: this figure could triple as DATs firmly establish themselves in the ecosystem.

‘We’re entering a new era. The momentum is strong. And this is likely just the beginning,’ Lilly concludes.

ETH +22% in July: How Far Can This Momentum Go?

With +22% since the start of the month, ETH is clearly leading the altcoin market this summer. And based on technical signals and inflows, the bullish momentum is far from exhausted.

A new Ethereum narrative is emerging: one of an institutional asset, integrated into balance sheets, used in treasuries, and yielding returns. The digital gold is already accepted; today, Ethereum becomes the productive engine of web3.