BlackRock integrates its Bitcoin ETF (IBIT) into certain model portfolios, with an allocation of 1% to 2%, marking a step towards the institutional adoption of BTC.

The announcement comes as Bitcoin drops to $78,000, after reaching a peak of $110,000, amid market correction and economic uncertainty.

Despite a slowdown in flows to the IBIT ETF, institutional demand for Bitcoin remains strong, and BlackRock is also adjusting its equity and bond allocations.

Strategic turning point for institutional adoption of Bitcoin

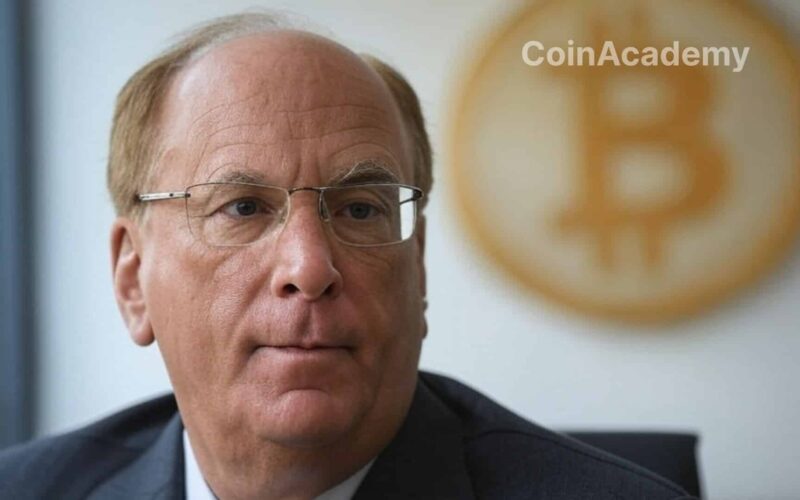

BlackRock, the world’s largest asset manager, is taking a new step in integrating Bitcoin into traditional finance by adding its Bitcoin ETF (IBIT) to its model portfolios. This allocation, ranging from 1% to 2%, specifically applies to portfolios that allow exposure to alternative assets. While this decision is limited to a subset of strategies offered by BlackRock, it could pave the way for broader institutional adoption.

We believe that Bitcoin has long-term investment value and can bring additional diversification sources to portfolios.

Michael Gates, head of targeted allocation portfolio management at BlackRock, justifies this choice by highlighting the Bitcoin’s ability to offer unique diversification.

Unstable market context

This announcement comes as Bitcoin undergoes a sharp correction, dropping from nearly $110,000 last month to $78,000 today. The decline in stock markets, combined with economic uncertainties and trade tensions, is weighing on the appetite for risky assets.

However, BlackRock had anticipated the high volatility of Bitcoin. In a December note, the BlackRock Investment Institute recommended not exceeding a 2% allocation, beyond which the risk associated with cryptocurrencies becomes too significant in a diversified portfolio.

An ETF losing speed, but institutional demand potential

Since its launch in January 2024, the IBIT ETF has seen spectacular inflows, attracting $37 billion in one year, making it one of the most successful ETF debuts in history. However, interest appears to be waning in recent days, with $900 million in withdrawals in the last week.

Despite this short-term decline in interest, the demand from financial advisors to integrate Bitcoin into model portfolios remains strong. According to Eve Cout, head of portfolio design at BlackRock, investors want to increase their exposure to alternative assets but are still looking for guidance on how to adjust and rebalance their positions.

A broader revision of allocations at BlackRock

The addition of the Bitcoin ETF is just one of several changes made to BlackRock’s model portfolio allocations. In a letter to investors, the team announced a reduction in equity exposure from 4% to 3%, due to slower earnings forecasts. Additionally, the bias towards growth strategies over traditional values has been reduced.

In the fixed-income segment, BlackRock has adjusted its exposure to long-term bonds. Massive capital movements were observed on Thursday, including a record influx of $2.3 billion into the iShares 10-20 Year Treasury Bond (TLH) ETF, while $1.8 billion left the iShares 20+ Year Treasury Bond (TLT) ETF.

A strong signal for Bitcoin’s integration into traditional finance

While the integration of Bitcoin remains moderate in proportion, it represents an important signal of its gradual acceptance by financial institutions. However, BlackRock reiterates its allocation convictions: equities over bonds, the United States over international, growth over value, and technology as a preferred sector. Nevertheless, the firm is now seeking to adjust these exposures more cautiously, in response to economic uncertainties and market dynamics.