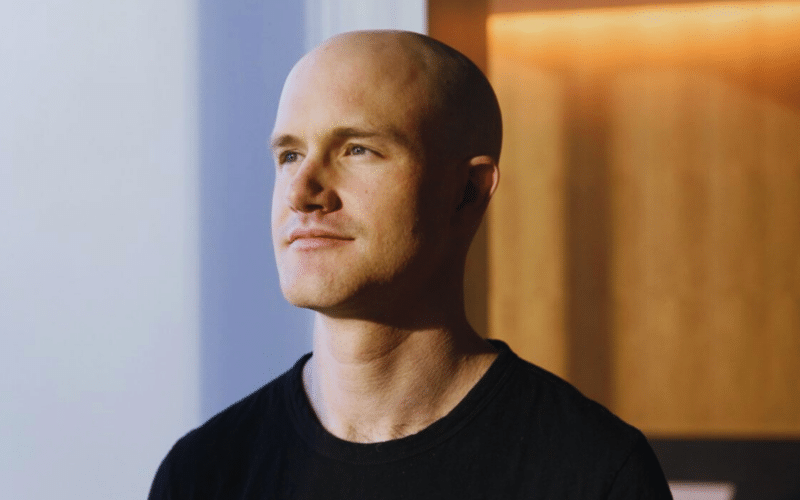

Actions of Coinbase Reach 18-Month High After Accusations Against Binance

The shares of cryptocurrency exchange platform Coinbase (COIN) have reached an unparalleled high in 18 months, following recent accusations against its competitor Binance and its former CEO Changpeng Zhao.

As a reminder, the former CEO of Binance pleaded guilty in court for violating bank secrecy laws.

On November 27th, Coinbase’s stock closed at $119.77, its highest level since May 5th, 2022. Despite this increase, the stock is still 65% lower compared to its all-time high of nearly $343 on November 12th, 2021.

Coinbase, a Key Player in Crypto ETFs

Meanwhile, Coinbase has solidified its position as custodian of 13 out of the 19 cryptocurrency exchange-traded funds (ETFs) currently awaiting approval from the Securities and Exchange Commission (SEC).

Some expert analysts agree that the SEC’s decision should be made before January 10th, 2024.

This position strengthens investor confidence in the company despite the challenging context marked by Binance’s legal troubles and the increasing regulation in the industry.

ARK Invest Sells $5.8 Million Worth of COIN Shares

ARK Invest, the famous Cathie Wood’s fund, has taken advantage of the recent surge in Coinbase’s shares to sell a significant portion of its holdings.

On November 27th, ARK sold 43,956 shares of Coinbase from its ARK Fintech Innovation ETF, totaling $5.3 million, when the stock reached $119.7.

As a reminder, in October, the company sold 63,675 shares, worth $5.1 million, from its ARK Next Generation Internet ETF (ARKW).