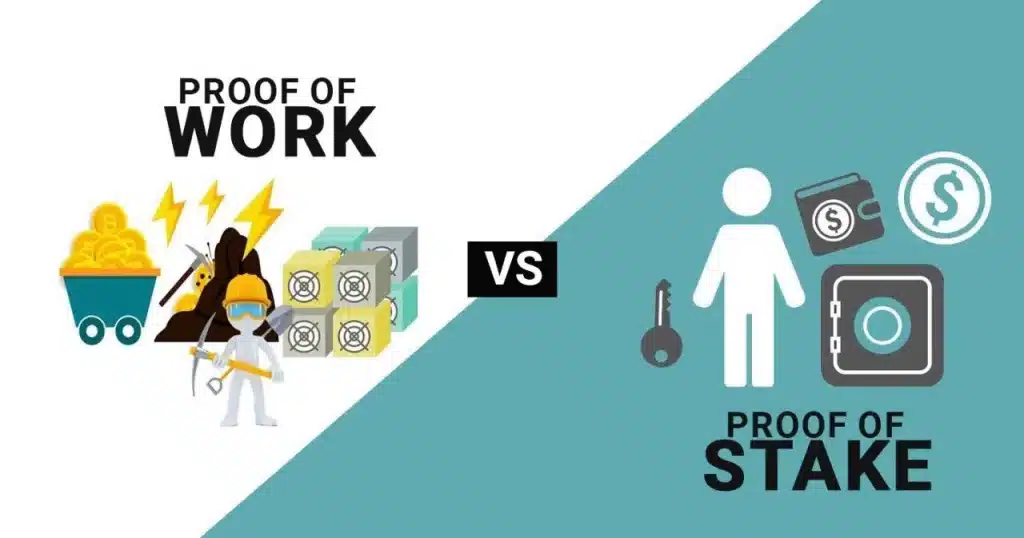

The Proof of Stake (PoS) is a substitute for the Proof of Work, known through Bitcoin, aiming to solve the limitations of the latter. This mechanism is much talked about as Ethereum plans, thanks to a consensus, to change its operating mode from Proof of Work to Proof of Stake.

Although few blockchains currently use this transaction validation system, the cryptocurrency world seems to strongly prefer the PoS / Proof of Stake process over the Proof of Work and its working algorithm.

As you may have discovered in our guide on Proof of Work / PoW, the function of these transaction validation systems is to guarantee the security of its network.

How does the Proof of Stake (PoS) work in cryptocurrency?

The Proof of Stake, like its cousin the Proof of Work / PoW, allows to validate, by blocks, transactions on the blockchain. The miners are called validators here and are actually nodes that compete without the help of any computing power. In this case, however, a certain number of tokens/coins of a crypto must be put “into play”, hence the name Proof of Stake. Nodes are randomly chosen to validate each block and be rewarded.

For a node, the greater the number of tokens staked, the greater the chances of it validating a block. By putting their tokens up as “collateral”, validators end up being rewarded, commensurate with their risk.

Rather than receiving a block reward, validators receive the fees spent by network users directly.

In order to motivate blockchain users to participate in the network, the “interest rate” reward offered to validators is very high when few participants are active and decreases when the number of potential validators increases, allowing a natural harmony.

What is the use of Proof of Stake (PoS)?

The Proof of Stake aims to solve the problems associated with the Proof of Work / PoW way of working. The energy consumption of a Proof of Stake network is much lower than that of a Proof of Work network since validators do not benefit from using more computing power.

The risks of deviation from decentralization are low with a Proof au Stake network when the market capitalization of the concerned crypto currency is high. Indeed, taking control of the blockchain theoretically requires owning and staking at least 51% of the entire digital currency.

This brings us a new argument, people wishing to attack a Proof of Stake network need to be an integral part of the network, which encourages validators to act in good faith in their own interests and therefore those of the network.

An example of a cryptocurrency using the Proof of Stake / PoS protocol is Peercoin.

What are the limitations of Proof of stake / PoS?

Few shortcomings can really be found in the Proof of Stake and these will generally depend on how this validation method is implemented.

A minimum amount of staking is often required to participate in the network and this amount can be high. This should for example be the case on the Ethereum blockchain with a minimum of 32 staked ethers to become a validator (substitute for the miner).

For the moment very little used, this technology must still prove itself, it seems nevertheless very promising.