The term market capitalization (or market cap) refers to a piece of data that indicates the size and performance of an asset or group of assets on a market.

The different types of market capitalization

Circulating supply market cap

Market cap is calculated by multiplying the circulating supply of tokens (or stocks on traditional markets), with the price of the asset in question.

Let’s take the example of an asset that is traded for 5 dollars and has a circulating supply of 10 million. Its market cap is equal to $5 x 10,000,000 which gives us 50 million dollars.

Fully diluted market cap

We can also talk about a fully diluted market cap, but what does this mean? Fully diluted capitalization includes tokens or stocks that are not yet circulating in addition to those already circulating.

Therefore, if the total supply of tokens for our $5 asset (same as our previous example) will eventually reach 50 million, its fully diluted market cap is equal to $5 x 50,000,000 or 250 million dollars.

How to interpret and analyze market cap?

The capitalization of an asset is not only a piece of data, it can also be used to analyze the importance and popularity of an asset on a given market.

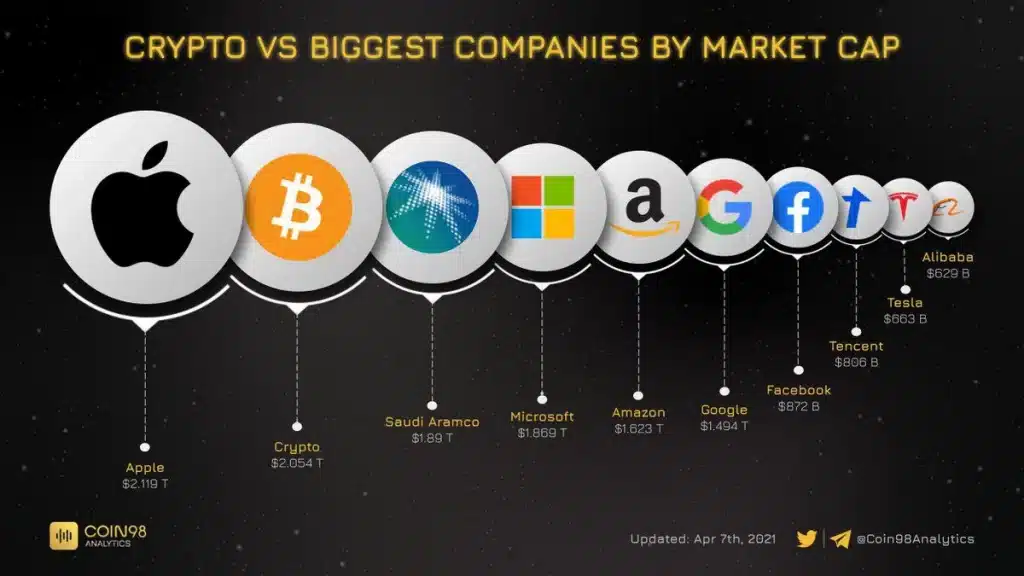

Indeed, if we take the example of Bitcoin (BTC) which is the most capitalized cryptocurrency, it is considered to be the “leader” of this market and, as such, often plays a very important role in the price variations of other cryptocurrencies.

In addition to determining the importance of an asset on a market, its capitalization also conditions its level of volatility. For instance, a cryptocurrency like Ethereum (ETH) with a capitalization of over $420 billion will tend to be much less volatile (both in bullish and bearish trends) than an asset whose market capitalization doesn’t reach the billion mark.

In other words, cryptocurrencies and other assets that have a multi-billion dollar capitalization are considered to be safer investments in the long run. Nevertheless, traders generally invest in low-capitalization projects for speculation purposes and to get much higher returns on investments.

Although the growth potential of low-capitalization projects is much greater, so is the risk of investments of this kind.

What are the analytical limits of market capitalization?

Market cap can be used to rank cryptocurrencies according to their market shares; you can find rankings of this type on CoinAcademy and CoinMarketCap for example.

Using the ranking of cryptocurrencies by market capitalization is a key indicator to determine whether a project is over or under-estimated.

Often put aside by rookie investors, this piece of data can give a realistic forecast of a project’s price evolution. For example, we could think that the current low price of DOGE is a golden investment opportunity if we thought that this price could reach that of Ethereum. However, the circulating supply of DOGE tokens demonstrates the irrationality of such a prediction.

Indeed, if we apply the aforementioned calculation to DOGE, its market cap would go up to 382,622 billion dollars, which is 517 times greater than Bitcoin’s capitalization; this shows the importance of having this data in mind.

The main takeaway of this article is that analyzing market capitalization for one or several assets can help you gain a better understanding of an industry, compare an asset to another in speculative terms, and solidify your trading strategy in combination with other indicators.