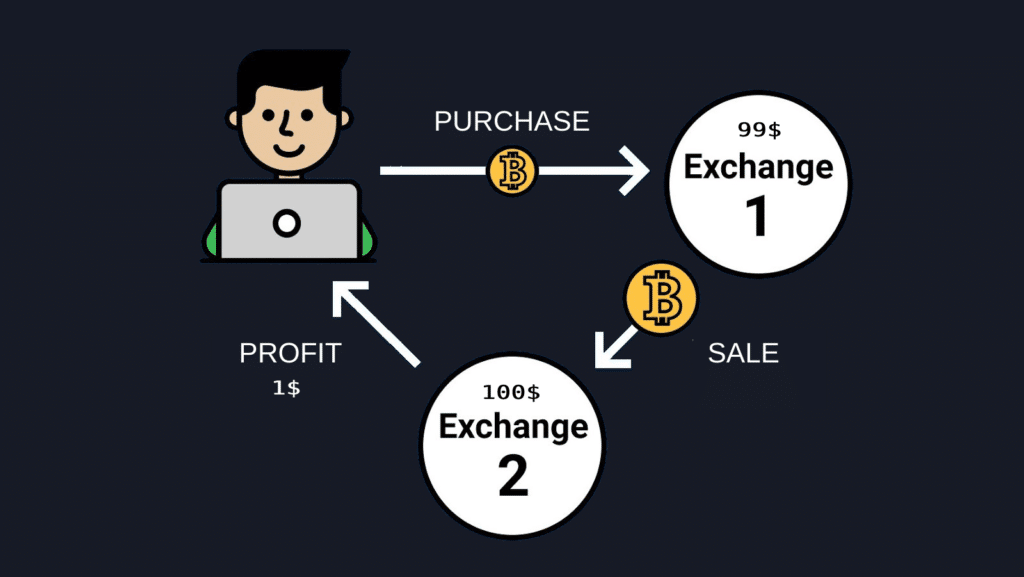

Arbitrage is a trading method that consists in making profits by exploiting a price difference between distinct cryptocurrency exchange platforms.

The arbitrage concept in crypto trading

Opportunities for arbitrage exist in a variety of markets, whether they are traditional financial markets, stock markets, cryptocurrency exchanges, online marketplaces like Amazon, sport bet websites, etc.

Arbitrage is a trading method that allows making profits by exploiting a price difference between two providers of the same service. In the world of cryptocurrencies, this consists in making a purchase on an exchange and selling this asset for a higher price on a different platform, thereby taking advantage of the quotation difference between the two.

A question comes to mind: why would there be a price difference for the same asset, product, or service?

Exchanges and financial markets are subjected to the law of supply and demand. The higher the demand is on a platform, the higher prices will go, and vice versa. This impacts the price of an asset independently from the will of a platform since each exchange platform is autonomous.

Consequently, within the global cryptocurrency market, each platform has its own “sub-market” wherein supply, demand, and market depth have a specific value.

An “arbitrage software” (or arbitrage bot) can be used to detect price differences between providers of the same product or service. The bot will then exploit this difference by buying an asset on the cheaper market and selling it on the one where the price is higher.

Example of an arbitrage opportunity with Bitcoin

This situation actually happened in April of 2021, following a strong and sudden rise of the demand on a Korean platform, which pushed the price of Bitcoin 17% higher than it was on the European market.

Bitcoin was sold for 57,000 dollars on the Binance platform, and for 66,500 dollars on the Korean exchange Bithumb. This is a significant price difference that makes for an arbitrage opportunity.

A trader could take advantage of this price difference by buying BTC on Binance for $57,000 and selling it on Bithumb for $65,000 in order to make a profit.

Risks of arbitrage opportunities in crypto trading

At first glance, arbitrage seems like an easy way to make money, but risks are involved in this practice and certain precautions are to be taken.

Indeed, although the core principle of arbitrage is very simple and based on a simple price difference between two platforms, some external factors should be taken into account in order to secure your investment.

Here’s a list of the risks involved in arbitrage:

- Be mindful of the exchange and deposit fees of the different blockchains and cryptocurrency exchange platforms when calculating the potential benefit of an arbitrage, so as to always make profits from your transactions.

- Check on CEX (centralized exchanges) that deposits and withdrawals are active; some withdrawals might be temporarily unavailable when a strong arbitrage opportunity arises.

- Take slippage into account when buying and selling the asset in arbitrage.

- Be reactive: most arbitrages are made by bots or traders that operate in timeframes of milliseconds.

Conclusion on arbitrage in crypto trading

Arbitrage is a trading method based on a simple phenomenon that occurs in all markets where a product or service can be exchanged.

Although simplistic in nature, its practice in a system that generates profits is far more complex and risky. Many external factors are to be taken into account and competition is fierce in this field, even in the cryptocurrency world.

The arbitrage phenomenon also allows for a market to autoregulate and balance itself on different platforms. By buying on a platform where the price of an asset is lower, demand for this asset will increase and push its price upward, and vice versa.