The execution of an order on any given market necessitates the mobilization of two different parties, namely a maker and a taker.

Indeed, when you wish to make a trade and open a position on any trading platform, you can either:

- place a limit order and be a “maker” (of the market)

- instantly enter the market by accepting the price offered by a maker, thereby being a “taker” (of the market)

In other words, a trader comes first and places an offer by bringing liquidity to the market, and then a second trader accepts the offer at this same price on the market in question.

Who are the makers?

The term “maker” designates an actor, such as a trader, who decides to enter a market by placing an order, which we call “limit” and is not executed immediately after being validated.

In other words, “limit” orders enable the purchase or sale of an asset at a set price. Once placed on the market, a “limit” order remains listed in the “order book” of the exchange platform as long as the asset in question does not reach its target price and another trader (taker) executes the order to fulfill their own demand (purchase or sale).

As a market maker, you will generally be subjected to significantly lower transaction fees because you will bring liquidity to the market, and therefore, will allow market takers to buy and sell an asset instantaneously.

If we take the example of FTX, this platform applies transaction fees of 0.02% to makers, whereas this percentage is set at 0.07% for takers.

On some platforms, if you bring a large amount of liquidity to the market as a maker, your fees can even become negative. This means users are paid by the platform for bringing liquidity and helping it function properly.

Liquidity is considered, by far, to be the most precious resource for a trading platform.

Who are the takers?

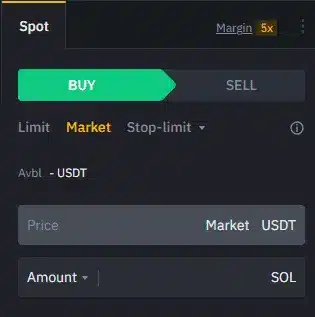

“Takers” are people who buy or sell their assets at market price, without their orders going through an order book. They make what we call “market” orders.

Furthermore, “market” orders are executed immediately at the most advantageous price on the market. As mentioned previously, the validation of “limit” orders is possible thanks to the “makers” who bring liquidity to the market and therefore, fulfill the demands made by takers.

In other words, when you place an order by choosing the “market” option, you act as a taker and, by doing so, execute an order which was pre-configured by a “maker”.

Conclusion

You can act on a market in two different ways: by bringing liquidity to the market (maker) or by taking liquidity from it (taker).

Platforms encourage their users to bring forth liquidity, therefore your fees as a maker who places “limit” orders will be a lot lower.

If it so happens that you don’t absolutely need to enter or leave a market instantaneously, it might be clever to focus on “limit” orders.