Table of Contents

- What is Binance Futures?

- Fees and commissions on futures

- Our opinion on Binance Futures

- Binance Futures: 2022 full tutorial

- How to open an account on Binance Futures

- Analysis of the trading interface of Binance Futures

- Trading options

- How to place an order on Binance Futures

- How can your positions be liquidated?

- Insurance funds

- Conclusion

- Discover our video tutorial on Binance Futures (in French)

- FAQ on Binance Futures

What is Binance Futures?

Binance Futures is an advanced trading platform launched in 2019 focusing on futures contracts. Traders have access to investing tools otherwise not available on the spot market.

Futures contracts on Binance Futures are reliable and safe ways to bet on a surge or drop of a cryptocurrency of your choice, such as Bitcoin (BTC) or Ethereum (ETH). These contracts provide you with a higher-risk exposure to cryptocurrencies through several options, including leverage.

Although this method enables you to earn money faster, it is also very risky and you might face significant losses. You therefore need to be very careful and do extensive research before investing in futures contracts.

This tutorial will detail each step, such as buying cryptocurrencies and the available functionalities. We will obviously also provide you with an honest opinion on the platform.

Fees and commissions on futures

Limit orders (Maker) have a 0.02% fee per transaction. In comparison, market orders (Taker) have a 0.04% commission per transaction, meaning twice as much as for limit orders. To save on fees, limit orders are therefore recommended.

However, users can pay their fees using BNB (Binance Coin) and receive a 10% discount on fees. To do so, you need to transfer some BNB from your spot account to your Futures account.

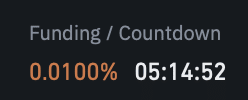

Funding rate

The funding rate is another type of fee charged by Binance Futures. Funding rates are periodic payments made for long or short positions on futures contracts. The rate is visible on top of the price graph and depends on the futures contract and the number of users with a position. It also depends on the current market trend (bull or bear).

In a bull market, the funding rate is positive and long traders pay short traders. Conversely, in a bear market, the funding rate is negative and short traders pay long traders.

Assuming a bull market, if the funding rate is 0.01%, long traders will pay a 0.01% fee to short traders who will receive a 0.01% bonus.

👉 Register for Binance Futures and save 20% on fees

Our opinion on Binance Futures

Pros:

- Complete trading interface

- Possibility to short

- Up to 125x leverage available

Cons:

- Risky for beginners

- Regular fees

Binance Futures: 2022 full tutorial

How to open an account on Binance Futures

To open a Binance Futures account, you must first log into Binance. If you do not have a Binance account yet, register on the website.

👉 Click here to save 20% on fees

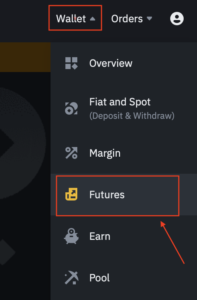

Once logged into your Binance account, click on “Wallet” (top right corner) and “Futures”.

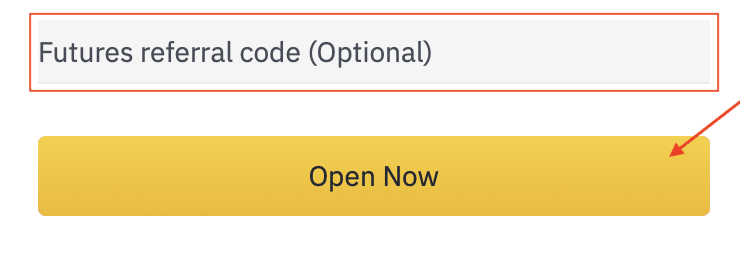

For a larger discount on fees, use the referral code COINACADEMY.

Following these steps, click on “Open account” to create your Binance Futures account.

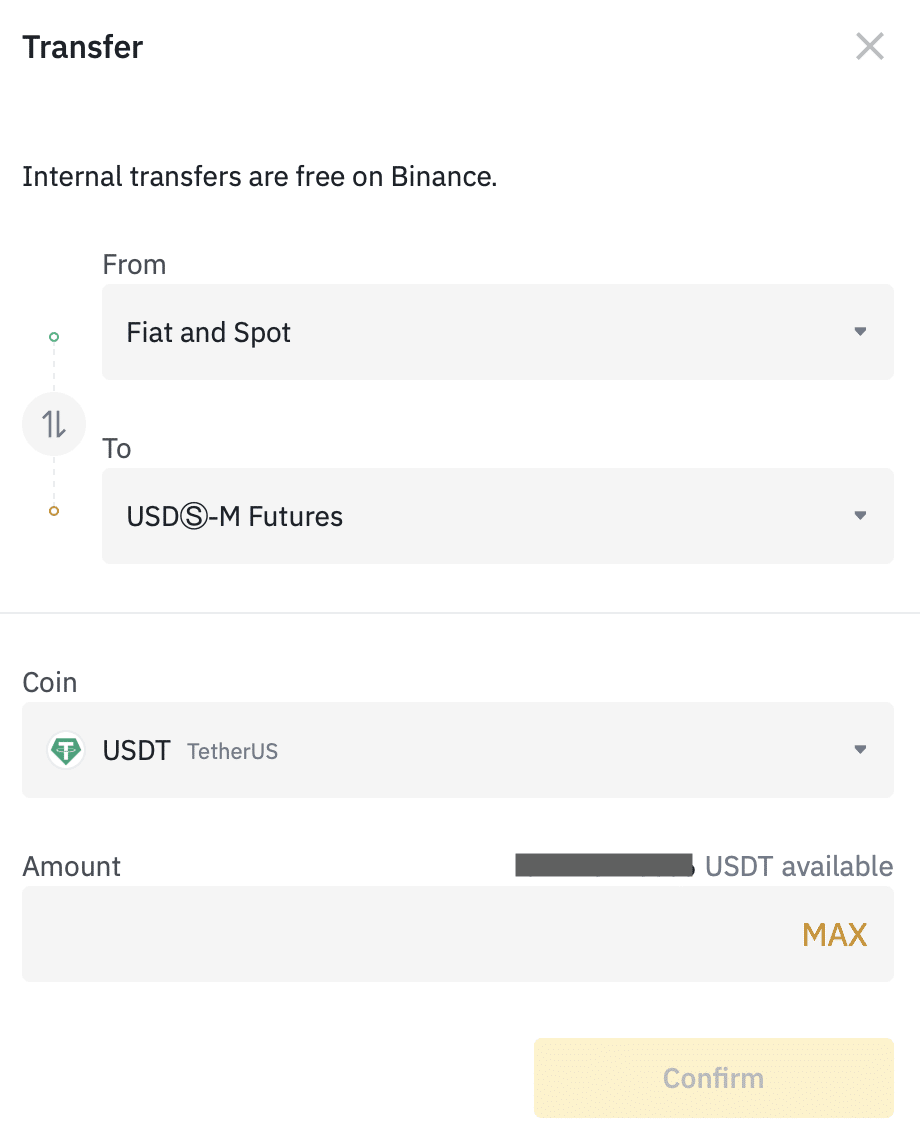

Congratulations, your Binance Futures account is now activated! To use Binance Futures, you still need to top up the account. To do so, you can click on “Transfer” on the top right part of the page to transfer money from your spot account to your future account.

You can also convert cryptocurrencies by clicking “Convert” or buy some with your credit card by clicking on “Buy crypto”.

Analysis of the trading interface of Binance Futures

Although the interface looks similar to that of Spot trading, there are a few additional functionalities.

For example, let’s look at the perpetual contract “BTCUSDT” (Bitcoin / USDT) to analyze in detail the information available on the interface:

- First, the current price of the futures contract is displayed

- The mark price is used to compute your PNL and the margin

- The index is used to analyze the price in comparison to the spot market

- The funding rate indicates the fees you will have to pay each time period

- The 24h change shows the price evolution of Bitcoin (for our example)

- Lastly, the 24h volume is displayed in both Bitcoin (BTC) and USDT

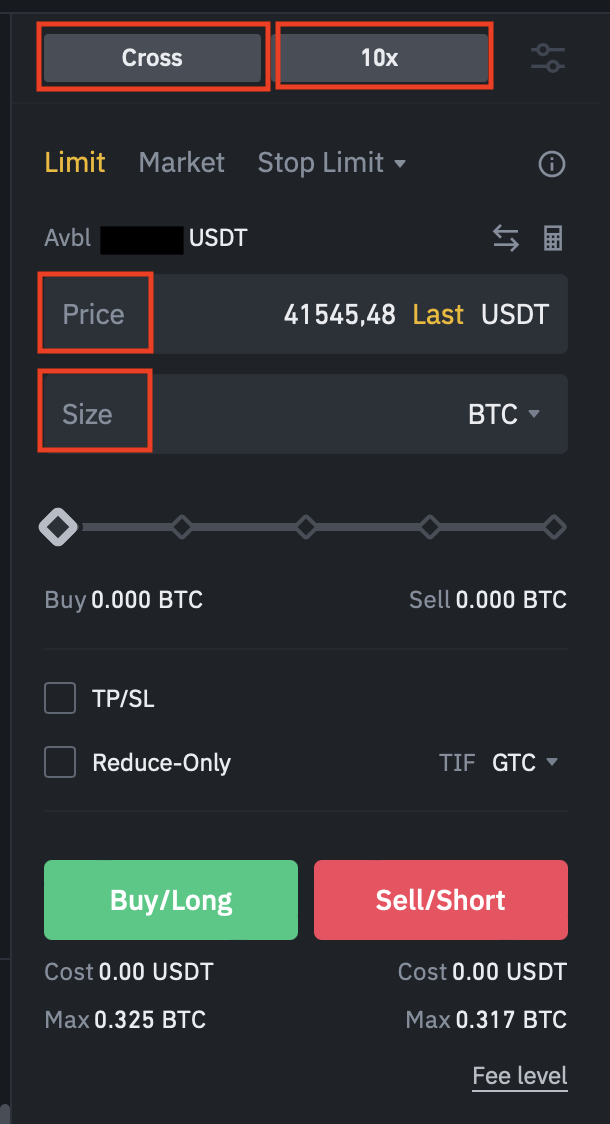

The right-hand side of the interface is mostly used to place orders, choose the margin method and the leverage that you wish to use.

Last but not least, the graph in the center shows the price of the chosen futures contract. The order book is shown on the right of the graph and displays live all open orders (buy or sell) on this contract / crypto.

Trading options

To explain to you how to place a futures contract order, we will detail the different trading options available to you.

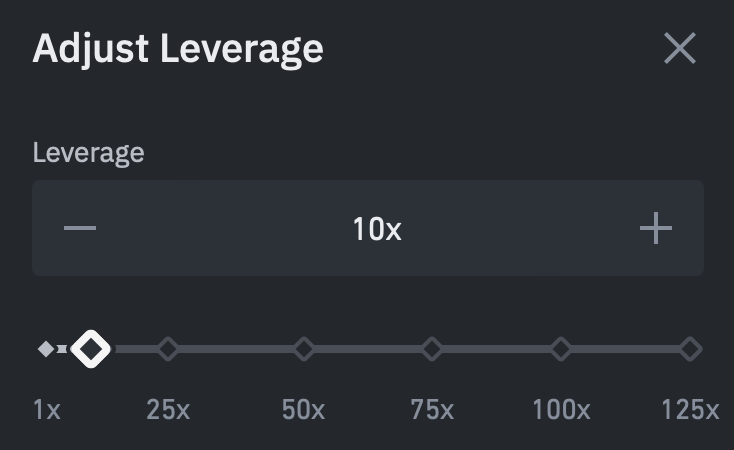

Leverage

Leverage is a very common tool on trading platforms. This enables you to artificially increase the size of your position without increasing your market exposure. However, the larger your leverage, the larger the volatility of your investment. The smallest price change can have a significant impact on your position.

For example, a 10x leverage on a $10 position leads to a $100 position without betting more. If the price of the underlying crypto doubles, i.e., a 100% increase, you will earn $100. However, if the price drops by only 10%, your position will be liquidated.

Although leverage can help you gain a lot more, your position can also be closed significantly faster. If you are a beginner or do not have substantial trading experience, we do not recommend using leverage.

👉 Register for Binance Futures and save 20% on fees

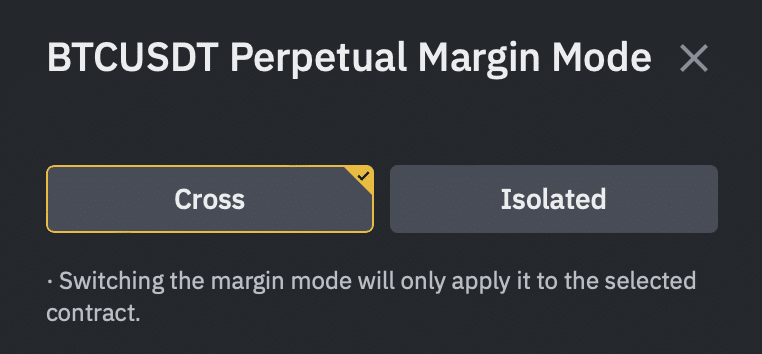

Margin methods (cross / isolated)

Cross margin:

This option uses all available funds in your Binance Futures account. In the event of a liquidation, the entirety of your available balance on your Futures wallet is used to avoid closing the position.

If you have a $100 investment in a futures contract and the price reaches the liquidation price, the cross margin will use your crypto balance to avoid closing your position.

Although the cross margin is used by some users, it can lead to significant losses. We do not recommend using this margin method if you lack trading experience.

Isolated margin:

This option is used by most users on trading platforms. It enables you to handle each position independently of the others. You can manually assign your desired capital to each position. If the price reaches your liquidation price, your position will be closed automatically. This significantly decreases the risks, and it surely is the safest and most suited method for most traders.

Position mode

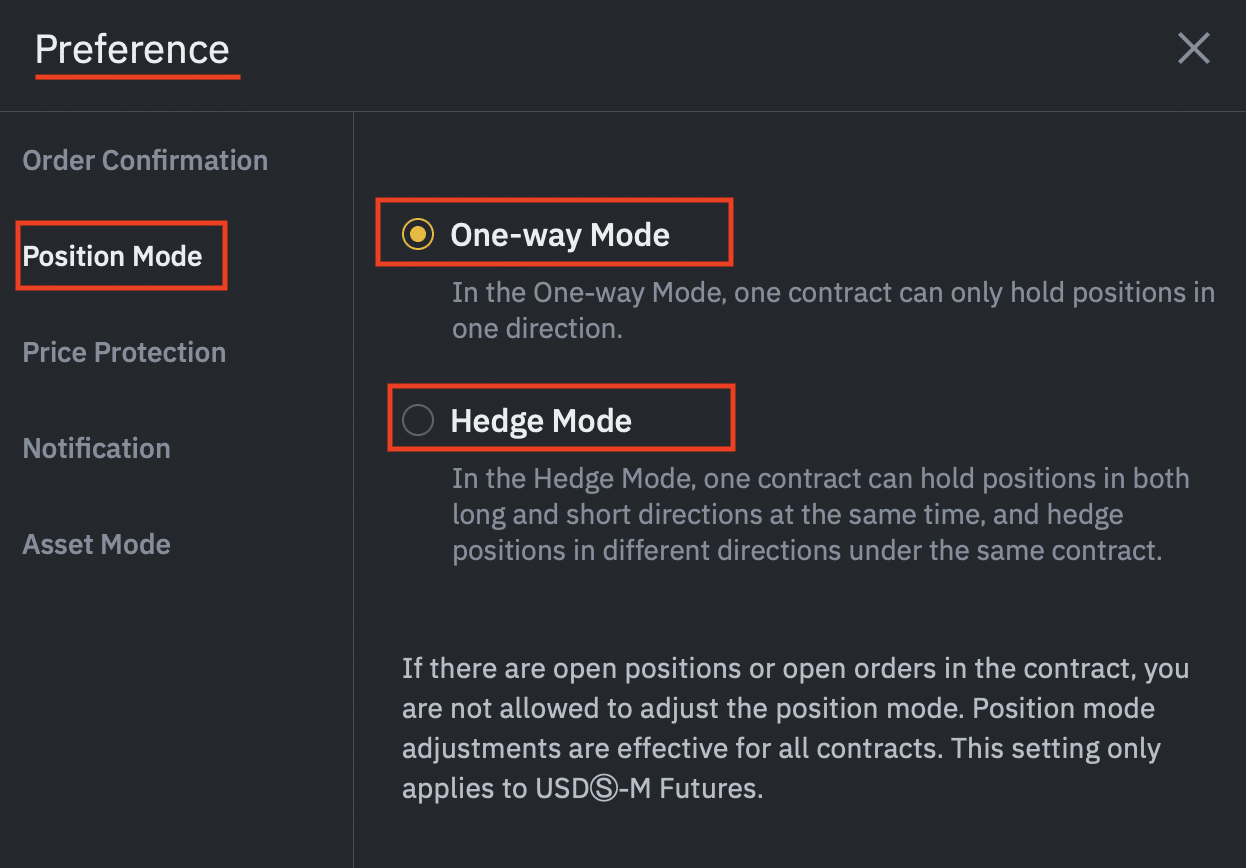

Two position modes are currently available on Binance Futures: “one-way mode” and “hedge mode”.

The one-way mode enables you to hold a position in only one direction (long or short).

The hedge mode enables you to hold positions in both long and short directions at the same time. This means that you can open a short position even if you already hold a long position (on the same contract).

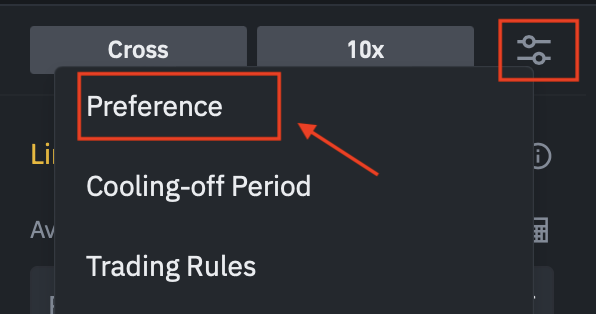

To choose the position mode, click on the tab on the right-hand side of the interface.

Click on “Preference” and “Position mode”. You can now choose the mode of your choice.

Take profit (TP) / Stop loss (SL)

Take profit (TP)

The take profit tool, also called TP, is an order that enables you to secure gains and take profits to reduce your exposure. You need to manually place the order based on the objectives you wish to achieve.

Stop loss (SL)

The stop loss tool, also called SL, is an order that gets triggered when the price reaches your predicted level. It enables you to limit the losses on your investment.

Different order types

Limit order

Limit orders are triggered when the price reaches the price of your futures contract. When you place a limit order, you act as a Maker as you bring liquidity to the market. The fees are thus significantly lower. Note that if the price is never reached, the limit order will remain open.

Market order

Market orders are immediately executed at the best available price on the market. However, you will pay the Taker fees, meaning you will take liquidity away from the market.

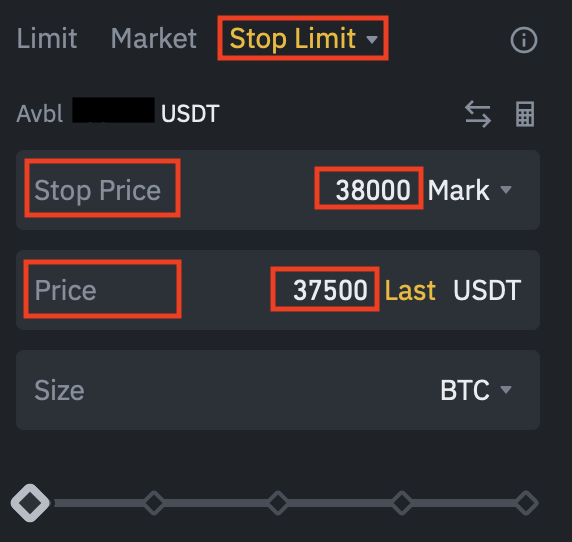

Stop limit order

Stop limit orders are slightly more complicated to understand for a beginner trader. Such orders get triggered in two steps: first at the stop price and then at the limit price. You must first define a stop price that, once reached, will trigger the limit price previously defined.

For example, if you wish to purchase Bitcoin (BTC) at $35,700 after its price reaches $38,000, you must indicate a stop price of $38,000 and a limit price of $35,700.

Stop market order

In a similar fashion to stop limit orders, stop market orders use a stop price which, once reached, will trigger a market order instead.

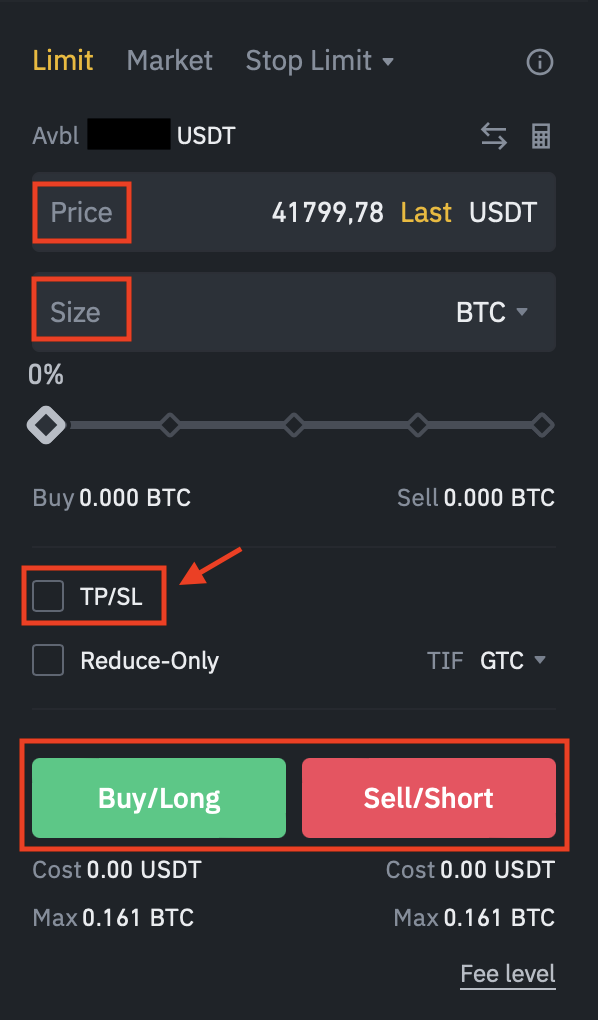

How to place an order on Binance Futures

In contrast to the spot market, you have two position types:

- Long: bet on a price increase

- Short: bet on a price decrease

First, choose the contract in which you wish to invest. As an example, we will choose the “BTCUSDT Perpetual” (Bitcoin / USDT).

Next, choose the margin method and the leverage. Here, we have chosen an isolated margin and a 5x leverage.

Next, indicate the amount you wish to invest on the contract. If you place a limit order, you must also indicate the price at which you wish to trigger your order. You can also add take profit (TP) and stop loss (SL) prices. To proceed with the order, click on “Buy / Long” to bet on a price increase or on “Sell / Short” to bet on a price decrease.

Once the order is executed, various data are displayed under the graph.

- Symbol: contract on which you are positioned

- Size: amount of your investment

- Entry price: price at which the order was triggered

- Mark price: price used to compute the PNL and the margin

- Liquidation price: price at which your position will be liquidated

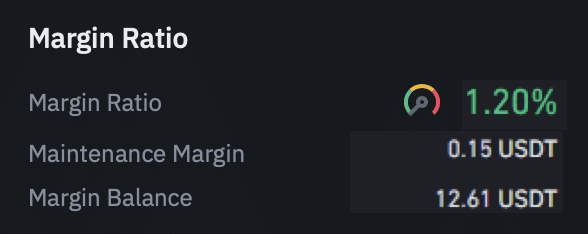

- Margin ratio: difference between the current price and your liquidation price. When it reaches 100%, your position is liquidated

- Margin: margin allocated to the position

- PNL (Profit and Loss): profit or losses of the position

To quickly close a position, you can click on the “Close all positions” tab and choose between “Market” and “Limit”.

👉 Register for Binance Futures and save 20% on fees

How can your positions be liquidated?

One of the main risks of futures contracts obviously is liquidation. This happens when the price of the underlying crypto reaches the liquidation price displayed on your order. The “margin ratio” is another available indicator.

The margin balance should never reach the displayed maintenance margin. It is the minimum amount required to keep your positions open. If your margin balance becomes smaller than your maintenance margin, your positions will be liquidated.

The margin ratio can be computed by dividing the maintenance margin by the margin balance. This ratio should never reach 100% or your positions will be liquidated.

In the event of a liquidation, all open positions are immediately closed.

Insurance funds

Binance Futures has insurance funds that add a safety net and additional protection for traders. These funds are of utmost importance for trading platforms that offer futures contracts.

Insurance funds are mostly used to avoid auto-deleveraging liquidations.

For further information on the insurance funds used by Binance Futures, click here.

Conclusion

Binance Futures is an efficient way for experienced traders to make profits. Futures contracts indeed offer several trading tools to users, including leverage. Additionally, the user interface provided by the platform is detailed and intuitive.

However, the crypto market is very volatile, and the reward potential is high. If you are not experienced enough, you first need to practice on the spot market. Despite its attractiveness, using leverage is very risky, and you might face liquidation at any moment.

For more experienced traders, we recommend starting with leverage smaller than 5x, which already means large volatility.

We hope that this English tutorial on how to use Binance Futures has helped you understand futures contracts better. You now need to do your own research and develop your own opinion, and only invest what you can afford.

👉 Register for Binance Futures and save 20% on fees

Discover our video tutorial on Binance Futures (in French)

FAQ on Binance Futures

What is Binance Futures?

Binance Futures is an advanced trading platform for futures contracts. It offers several investing tools and an ideal trading experience for experienced traders. You can find several cryptocurrencies, such as Bitcoin, Ethereum, and many others.

How to save on fees on Binance Futures?

First, favor limit orders over market orders to pay lower fees. Additionally, if you pay your fees using BNB, the native Binance token, you will save an extra 10% on fees.

For further discounts, don’t hesitate to use the referral code COINACADEMY when opening your Binance Futures account.

Is it risky to invest on futures contracts on Binance Futures?

Yes, using leverage increases your risk exposure, such as the liquidation of open positions. It is therefore of utmost importance to first gain experience and knowledge before investing in such contracts.

Is investing on this platform safe?

Yes, Binance Futures is a very reliable and safe way to invest in futures contracts. Additionally, insurance funds are available to increase this safety.

Grade: 4.7/5 with over 521 votes