Trader Joe, the first decentralized exchange on the Avalanche blockchain. An all-in-one protocol that allows you to trade, stake, farm, lend and borrow in one click.

Introduction to Trader Joe, Avalanche DEX

Trader Joe is the first decentralized exchange platform (DEX) of the Avalanche blockchain. The platform allows peer-to-peer trading without middlemen through an Auto Market Maker (AMM) and generates passive income by providing liquidity, staking and farming, a process usually called yield farming.

The ecosystem is driven by and for the user, The protocol is managed through smart contracts which makes the Trader Joe ecosystem sustainable and decentralized.

Today, Trader Joe represents more than $300 million dollars of daily volume. Soon it will represent 1000 liquidity pairs and a TVL (Total Value Locked) of $1 billion dollars.

Trader Joe, Avalanche crypto DEX

At that time, Pangolin was the first DEX on Avalanche. However, Pangolin struggled to innovate and didn’t match the customers’ needs. Trader Joe came later, in June 2021. It quickly became the leader by overtaking Pangolin’s TVL.

Modern interface, features, and yield farming are part of their winning strategy, such as the backstory on the Farmer Joe meme. Users became attached and pushed the project to the top.

In early September 2021, Trader Joe raises $5 millions dollars in a strategic sale. Among the investors, several big entities in the DeFi ecosystem such as Delphi Capital or 3AC.

Trader Joe is also known for its user-friendly interface and does not hesitate to offer innovative farming tools and functionalities.

Joe token, cryptocurrency on Avalanche

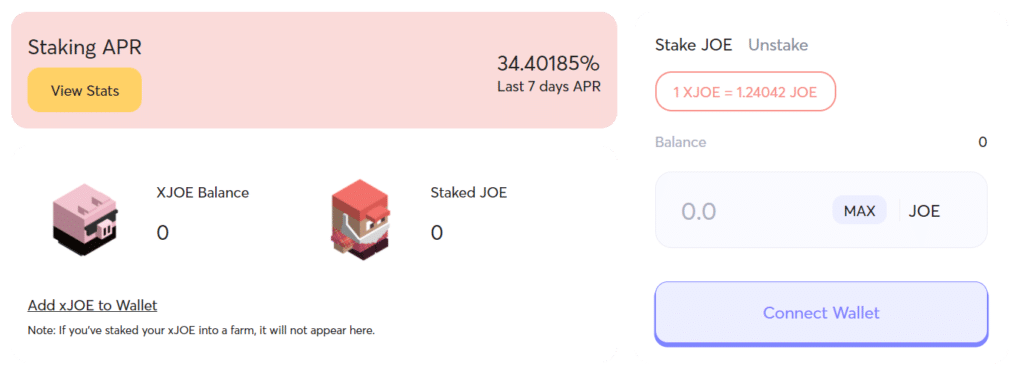

JOE is the native token of the protocol. You can stake it, in order to get xJOE, the governance token. By holding this currency, you will be able to vote and influence the decisions of the protocol. Part of the fees are distributed to xJOE stakers and allow daily buyback of JOE, bringing a constant buying pressure.

Features on Trader Joe, the Avalanche crypto DEX

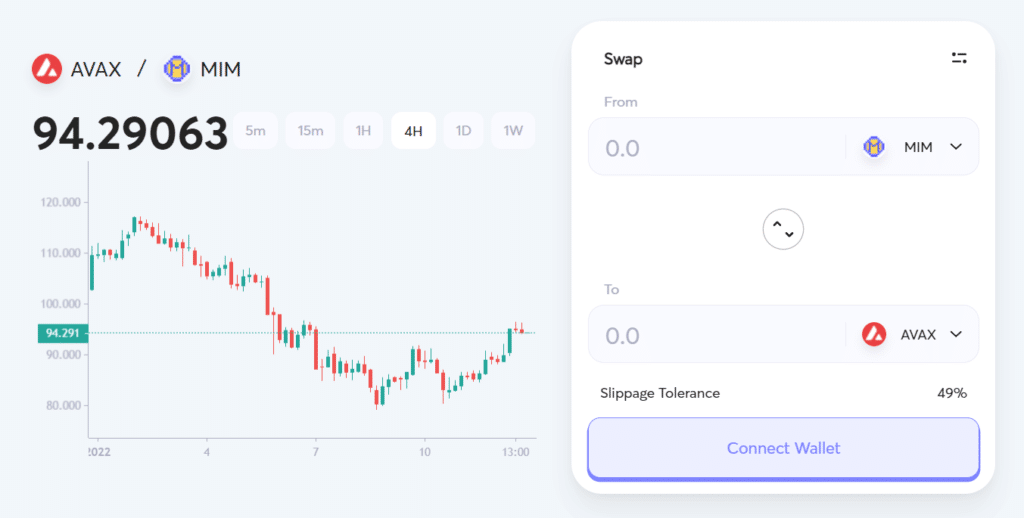

Swap

Of course, Trader Joe brings you the possibility to swap tokens. Their personal touch is the integration of the price chart, allowing you to directly see the fluctuation of the price. This is a real benefit and makes the swap more user-friendly.

You can also adjust slippage to match the available liquidity with the pair of tokens you want to swap.

A new feature will soon be added, and will allow users to set orders limit directly on the DEX.

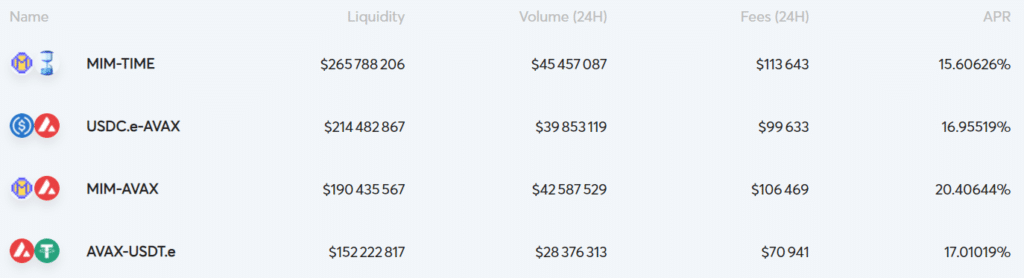

Liquidity providing

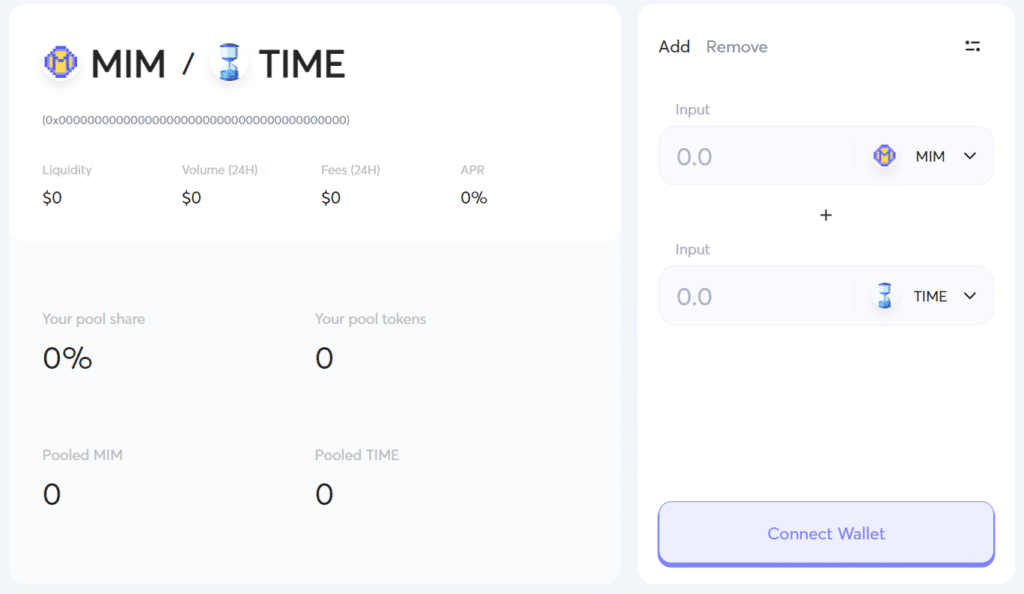

You can bring liquidity to different pools.

In order to add liquidity, you must deposit a pair of tokens (i.e. MIM and TIME), with the same value for each token. In return of this pair, you will get LP tokens, which will represent the value of your deposit in the liquidity pool. You can change them at any time against the tokens you initially had.

By adding liquidity, you allow other users to swap the token you deposited. You are rewarded by getting the transaction fees. Most of the pools currently have a 20% APR.

The “ZAP” feature allows you to deposit only one asset in a pool. The protocol will automatically convert the value of your deposit and split it into two assets. This avoids multiple transactions and the fees associated.

By depositing liquidity in pairs, you are subject to impermanence loss. I invite you to inquire about this subject to avoid unpleasant surprises.

Farming

Once your liquidity is deposited, you have LP tokens. These represent the amount of token you deposited in the protocol. Using these tokens for yield farming is a way to increase your benefits and yields.

In exchange for your deposit of LP token, you will get JOE. Each pool has its own APY, which is higher when the protocol needs to attract liquidity in a specific pair of tokens.

Staking

Moreover, it is possible to stake your JOE, in order to get xJOE and 30% APY more. If you then deposit your xJOE in pools, you will be rewarded in JOE and by repeating this routine, you can optimize your yield farming.

Returns come from liquidity incentives and fees generated by activity on the platform. Liquidation profits and half a percent of fees is redistributed to xJOE stakers.

Banker Joe

Since the beginning of October, it is now possible to borrow cryptocurrency directly on Trader Joe, similarly to Compound or AAVE. Users can lend their cryptocurrencies for a yield, and use them as collateral for a loan. The TVL (Total Value Locked) is around $1 billion dollars.

The team is currently working on a system to use leverage on the yield farming of their platform.

Liquidation profits and a portion of fees are redistributed to xJOE stakers.

Rocket Joe

Rocket Joe is the new innovative functionality on Trader Joe. Fundamentally, it is like a Launchpad using the benefits of the current Trader Joe functionalities.

Users will be able to stake their JOE in a special pool to earn rJOE, the token allowing you to have an associate allocation of the IDO. For each 100 rJOE you will be able to invest 1 AVAX in the initial LP.

After the public launch, your LP tokens will be vested during one week, but you will be able to earn trading fees during this period.

Rocket Joe is a facilitator of sustainable launches for the Avalanche community. Rocket Joe expands the Trader Joe platform and setting foundations for a wider overhaul to tokenomics.

Conclusion about Trader Joe, Avalanche crypto DEX

Today, Trader Joe is a must-have for DeFi on Avalanche. The protocol has been able to quickly establish itself and take the lead by delivering new innovations, performance and attention to its users.

The protocol also uses the JOE meme through Twitter, and as you can imagine its impact on the community.

Trader Joe is meant to be an all-in-one protocol, allowing you to swap, provide liquidity, farm, stack, borrow, lend… and many other features are in development.