The $USDN algorithmic stablecoin has fallen sharply against the dollar, reaching $0.83 as the WAVES project and its founders are accused of running a massive ponzi scheme.

Algorithmic stablecoins are becoming increasingly popular, although many consider this to be still in the testing phase at the moment.

$USDN is the algorithmic stablecoin of the Waves protocol. A simplistic comparison is $USDN = $UST and Waves ($WAVES) = Terra ($LUNA).

Using this comparison, the flagship protocol of Layer 1 Waves is Vires Finance (which can be compared to Anchor protocol at Terra).

Impressive growth, WAVES outperforms the market

The reasons for the impressive performance of the Waves ecosystem and its native token in recent months are not entirely clear. Initially dubbed the Russian Ethereum, Waves has reportedly benefited from the Russian invasion of Ukraine and subsequent financial sanctions. Inexperienced traders love to ride on narratives like this and it’s nothing new, but this surge in the price of $WAVES seems to have caused a snowball effect.

What is the function of Layer 1 Waves?

$WAVES primarily mints the native stablecoin of the $USDN ecosystem, but also backs it up to ensure a price equivalent to $1.

By purchasing $WAVES, the user can then obtain $USDN and stake it for a lucrative yield. The price of $WAVES and the quantity of tokens in relation to the number of $USDN are variables that impact the yield perceived by the stakers.

The Vires Finance protocol, responsible for most of the TVL Waves, offers a classic lend/borrow system, but the borrowing rates seem abnormally high, far too high to be interesting. The volume of transactions on the network is also far from historical highs, yet the price of $WAVES has been soaring recently.

This would seem to stem from extremely high trading volume in Korea, most notably on the UpBit exchange, where the $WAVES token is among the most traded, surpassing even Bitcoin for some time.

With a majority of the tokens stacked and hyper speculation, the price of $WAVES has been able to take off, raising the yield of the $USDN yield with it. The high rates then attracted new users, fans of yield farming, into the ecosystem. But to sustain these rates and thus stabilize the ecosystem, the price of $WAVES must continue to rise.

Is Waves a different kind of ponzi than finance in general?

This is where accusations of a Ponzi scheme come in. Indeed, many users suspect the team behind the Waves protocol, and more specifically Sasha Ivanov, of artificially inflating prices.

An isolated wallet started following a rather shady transaction structure:

- Depositing a large amount of USDN on Vires Finance

- Borrowing USDC / USDT on Vires Finance

- Transfer USDC / USDC to centralized exchanges

- Buy WAVES on centralized exchanges

- Exchange WAVES for USDN

Sources: wavesexplorer and etherscan

transaction waves

transaction waves

transaction etherscan

transaction waves

transaction waves

adresse waves

The wallet ends up with USDN again and can restart the loop by depositing its tokens on Vires Finance. If this wallet really belongs to the Waves team, then the accusations of ponzi would be at least partially true.

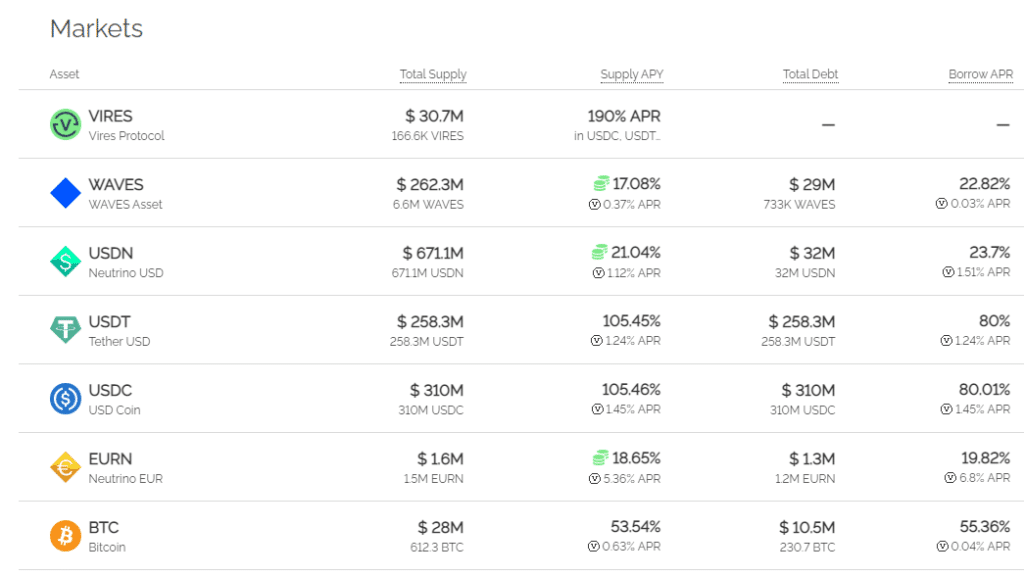

To attract users to deposit their USDC / USDT on the Vires Finance platform (and to be able to exchange USDN for these stablecoins), the rates offered are well above the market (they reach today more than 100%).

This leverage system in addition to a limited supply would artificially inflate the price of $WAVES and attract traders in a snowball effect.

Of course, this loop cannot last forever and is usually set up to draw maximum attention to the protocol so that it survives without “outside help” afterwards.

Every couple of days, the deposit of USDN, on Vires Finance in order to buy more WAVES causes a green candle and restarts the growth of the ecosystem, until the people responsible for these loans/purchases run out of liquidity.

The end of the tunnel for Waves and USDN

While the price of the WAVES token has suffered “only a 15% drop”, the price of the USDN has fallen away from the US dollar, losing its stability and therefore its main function.

According to Sasha Ivanov (Waves), the main culprits are traders who short the $WAVES, such as the Alameda Research fund (FTX).

Accusations of market manipulation from both sides follow. Ivanov accuses Alameda Research of forcing Waves to fall with a loan of 630,000 WAVES (nearly $30 million at the time of the loan) in order to short the token.

Yet the founder of Waves did not respond when he was accused of controlling the wallet responsible for a reverse (long) move on WAVES to the tune of several hundred million dollars.

As the community began to question the reliability of the team behind Waves and the viability of the project, many users began to want to withdraw their funds from the Vires protocol.

As a result, lending rates soared to staggering levels:

The Waves team is encouraging its holders to open long positions en masse to cause a short squeeze and liquidate all short positions, including Alameda Research.

Taking it a step further, a proposal by DAO Vires Finance plans to liquidate all short positions in the DeFi protocol by retroactively changing the borrowing rules.

Everyone who borrows any of the $USDN and $WAVES tokens on Vires Finance would be liquidated instantly.

At the same time, many features of the Vires protocol are disabled and many users complain that they cannot withdraw their funds. Borrowing from USDN and WAVES is disabled pending the results of the proposal vote.

The team behind Waves seems to be losing the trust of its users, but its consequent borrowing situation is forcing it to such solutions to avoid its own liquidation. Of course, the massive outflow of funds eventually caused the price of the USDN, which is considered a stablecoin and supposedly worth $1, to fall.

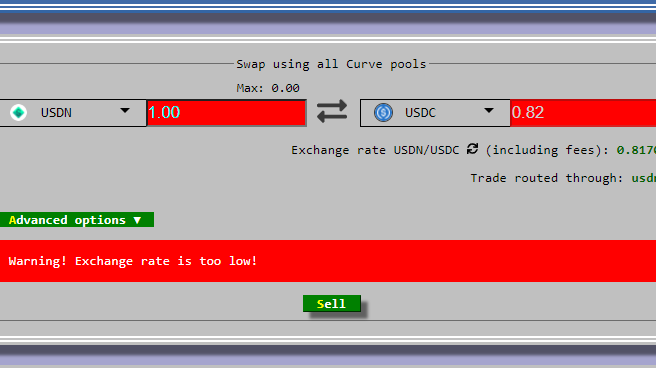

The $USDN token is trading around $0.82 on the number 1 Curve Finance stablecoin DEX at the time of writing.