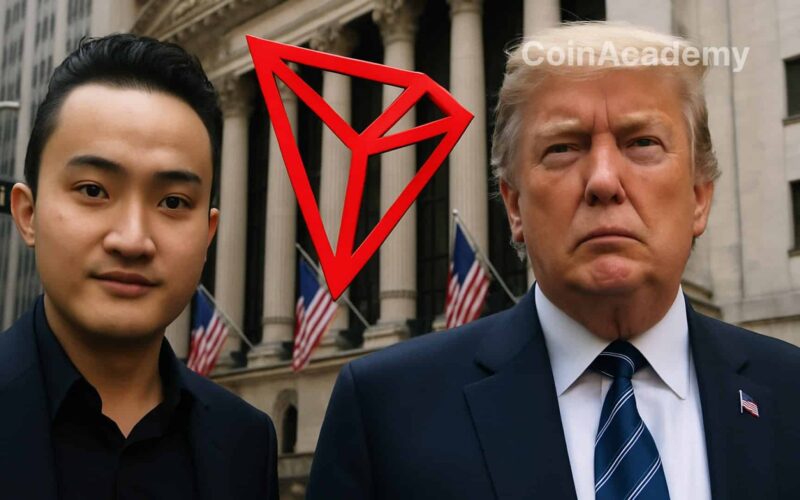

Justin Sun is preparing Tron’s IPO through a reverse merger with SRM Entertainment, supported by Dominari Securities, a bank linked to the Trump family.

Tron Becomes a Strategic Tool Aligned with Donald Trump

Stablecoins issued on its blockchain, $75 million invested in the Trump family’s crypto holding, and dining alongside the president mark Tron’s strategic alignment with Donald Trump. The operation has significant political ramifications, merging crypto, finance, and Republican influence, with a focus on the bull run… and the 2028 elections.

The SEC has paused its investigation. Crypto billionaire Justin Sun moves swiftly to action: Tron is set to go public in the US in a spectacular operation involving tokens, Donald Trump Jr, stablecoins, and possibly even a comeback for the Trump-made crypto dollar. According to the FT, Eric Trump could play a significant role in the company.

Tron to Go Public through a Reverse Merger

Four months after the SEC suspended its investigation into market manipulation and illegal securities sales, Justin Sun returns to the spotlight. His crypto group Tron is gearing up to enter the stock market through a reverse merger with Nasdaq-listed SRM Entertainment. Behind the operation lies the discreet yet highly political Dominari Securities, close to the Trump sons.

A new entity named Tron Inc will emerge, holding up to $210 million in TRX tokens. The goal is to replicate Michael Saylor’s strategy with MicroStrategy, transforming the company into an amplifier of the underlying asset’s price.

The Trump-Endorsed Crypto of Sun?

Since Donald Trump’s return to the White House, pro-crypto signals have been abundant. Justin Sun seizes the opportunity. In May, he is pictured alongside the president at a banquet reserved for the top holders of the memecoin $TRUMP. More than just a dinner: a clear message to the industry.

Sun also injected $75 million into World Liberty Financial, the Trump family’s crypto company. It has already paid out $57 million to the former president… and has just issued its first stablecoins on the Tron blockchain. Sun’s way of killing two birds with one stone: monetize his infrastructure while aligning with the current administration.

A Political Flair, a Taste for Showmanship

Justin Sun never does things by halves. In 2019, he spent $4.6 million to have lunch with Warren Buffett. In 2023, he splurged $6.2 million for… a banana taped to a wall, which he ate in front of the press. Today, he comes back strong with a high-stakes IPO and an explosive alliance with the Trump sphere.

Officially, he has no direct ties to China. He is now a citizen of Saint Kitts and Nevis and a former ambassador of Grenada to the WTO. A position that allows him to play on various fields, between tax havens, diplomacy, and decentralized finance.

An Operation with Deep Political Ramifications

The deal goes beyond Tron. Dominari Securities, based in the Trump Tower, two floors below the Trump Organization HQ, is also behind the rise of American Bitcoin, formerly American Data Centers, a BTC miner recently merged with Hut 8. This same holding saw its stock price soar +580% after the announcement of the Trump sons joining its board.

One thing is certain: Tron is gearing up for its comeback in the American game, with all the elements of a political-financial saga. Blockchain, tokens, mining, stablecoins, and executive power intertwine in a strategy designed for the bull run… and for 2028.