The Unstable TUSD of TrueUSD in the Market

- TrueUSD has fallen to around $0.9685, deviating from its anchoring to the US dollar.

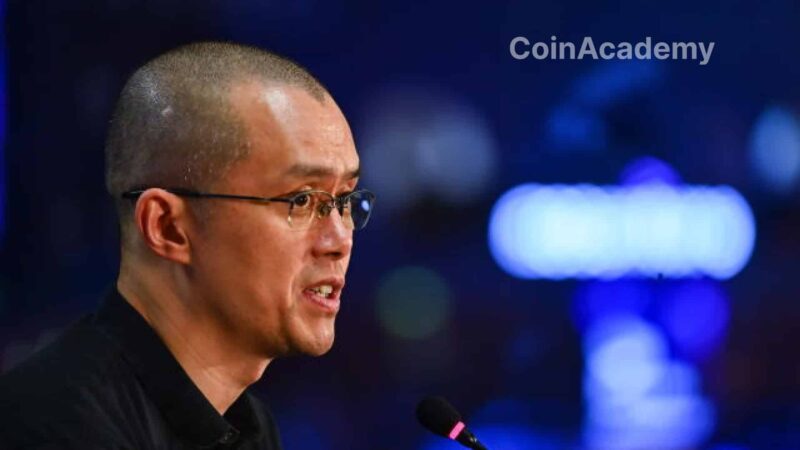

- Binance recorded massive sales of TUSD on its platform, indicating a significant net outflow.

- TrueUSD updates its fiduciary reserve auditing system in partnership with MooreHK.

The stablecoin TrueUSD (TUSD) has experienced a notable decline, dropping to a low point of around $0.9685 around 2 a.m. in France. Since then, the price of the stablecoin has recovered and is now trading around $0.99.

On January 15th, a massive sale of several hundreds of millions of dollars’ worth of TUSD was observed, with data from Binance showing sales of about $238.3 million worth of TrueUSD, against purchases of about $83.8 million, indicating a net outflow of $154.5 million.

On January 10th, it was reported that TrueUSD had suspended the publication of its real-time attestations regarding its reserves. These attestations are regular proofs provided to confirm that each circulating TrueUSD token is backed by a real US dollar held in reserve. The suspension of these attestations raised concerns among investors and TrueUSD users.

TrueUSD attributed this incident to several internal errors. On January 18th, TrueUSD announced that it had fully upgraded its fiduciary reserve auditing system in partnership with the Hong Kong-based accounting firm, MooreHK.

This update includes “additional details on reserve funds” held by its financial and fiduciary partners. Justin d’Anethan from Keyrock suggested that MANTA’s recent announcement in Binance’s Launchpool program and the need to stake BNB or FDUSD may have prompted investors to sell TUSD in favor of MANTA.