Tether, the leading stablecoin issuer, has recently reported record profits, further solidifying its dominant position in the market. According to its latest quarterly report, Tether generated an impressive $2.85 billion profit, thanks in part to the interest earned on its extensive investments in US treasuries, reverse repos, and money market funds. These investments are crucial in supporting the value of its stablecoin USDT.

Diversification of Revenue Sources

In addition to interest income, Tether has also benefited from the appreciation of its other investments, including bitcoin and gold. Over the past year, the company has recorded $6.2 billion in net operating profits, with approximately $4 billion coming from interest on its cash holdings. The Federal Reserve’s campaign to raise interest rates to combat inflation has also worked in Tether’s favor, increasing the returns on its fixed income investments.

Financial Strength of Tether

According to the latest attestation signed by BDO Italy, Tether has disclosed $97 billion in assets held in reserve against $91.6 billion in liabilities as of December 31, resulting in $5.4 billion in excess reserves. USDT, the most popular stablecoin and essential to the crypto market, has reached a record $96 billion market capitalization.

Tether’s Investments and Outlook

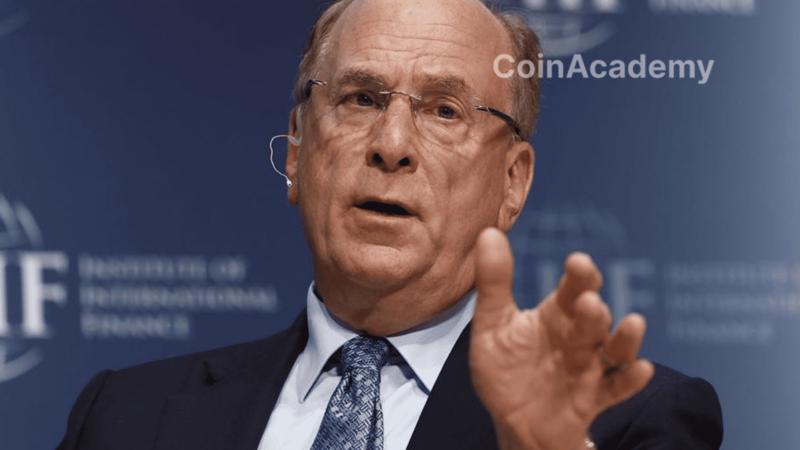

Tether is not limited to issuing stablecoins but has also diversified into areas such as bitcoin mining, artificial intelligence, and telecommunications. Despite past concerns about the quality of assets backing USDT, financial figures like Howard Lutnick of Cantor Fitzgerald have recently confirmed Tether’s financial strength.