Tether, the powerhouse behind USDT, is gearing up to launch a new stablecoin tailored specifically for the United States: USAT. The goal is clear: to reach 100 million Americans upon its anticipated December release. This time, Paolo Ardoino aims to compete on the same playing field as PayPal, Apple Pay, and local fintechs, but with a 100% crypto approach and full compliance with federal regulations.

A “Made in America” Stablecoin

Unlike USDT, often constrained by its offshore presence, USAT will be issued by Tether America, a joint venture with Anchorage Digital, one of the few regulated crypto banks in the U.S. This new token will adhere to the requirements of the GENIUS Act, a regulatory framework now governing dollar-denominated stablecoins. The aim is to provide a digital currency capable of competing with traditional payment solutions while remaining pegged to a fully regulated dollar.

For the American market, a more professional and digital currency approach is needed.

We already have a user base eager to use it in the real economy.

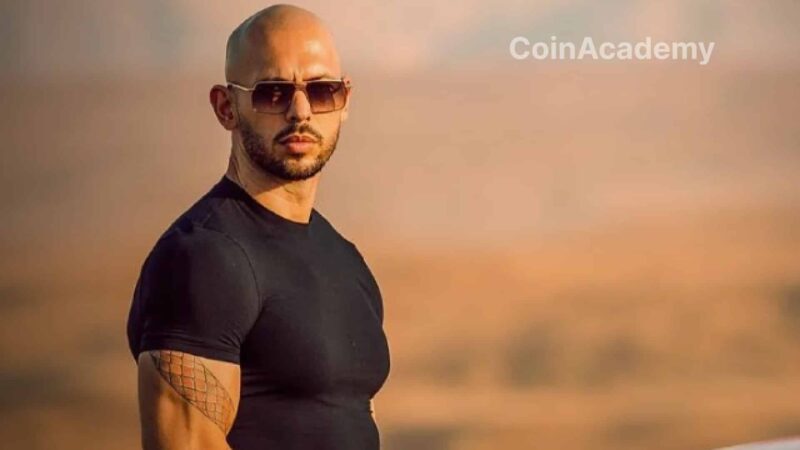

Paolo Ardoino

The Rumble Strategy: Crypto and Creator Economy

To roll out USAT on a large scale, Tether is banking on an already massive network: Rumble, the video platform in which the company invested $775 million last year. With 51 million active users in the U.S., Rumble will serve as the primary launchpad for integrating the stablecoin, notably through an expected native crypto wallet by the end of the year. Ardoino then aims to double this user base by partnering with other social and content platforms, positioning USAT as the go-to currency for creators.

We are going to hit the ground running and regain market share from those who have tried to eliminate us.

USDT Still Dominating

While Tether prepares for its American expansion, USDT continues to crush the competition. Its market cap now stands at $182 billion, representing over 60% of the global stablecoin market. Against it, Circle and its USDC rise to $72 billion, a significant increase, but still far from the undisputed leader. Tether’s growth is driven by demand in emerging markets, as well as a more favorable regulatory environment in the U.S.

Tokenized Gold, Another Gem of the Group

Meanwhile, Tether Gold (XAUT) is experiencing a meteoric rise. Buoyed by the historic surge of the yellow metal, the token backed by physical gold has seen its market cap triple to $2.2 billion. Ardoino specifies that this growth largely comes from retail, particularly in Latin America and Asia, where demand for digital gold is soaring. Even market makers are seizing it to play price differences with CME futures contracts.

At this pace, Tether asserts itself more than ever as the most powerful conglomerate in digital finance, juggling between regulated dollars and tokenized gold, with a single ambition: to dominate both emerging markets and the U.S.