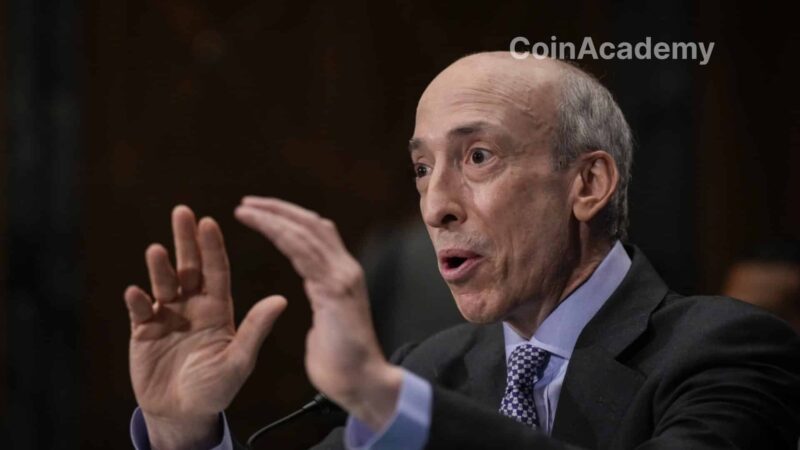

Terraform Labs’ Strategy to Counter the SEC:

Terraform Labs, facing a fraud lawsuit from the US Securities and Exchange Commission (SEC), has found a way to challenge this legal action by invoking Chapter 11 bankruptcy protection.

In a recent court filing, the company states that this protection is essential for it to continue operating, preserve value for its creditors and stakeholders, and most importantly, pursue an appeal against the SEC’s action.

This move aims to provide an orderly process to resolve ongoing claims while seeking to reduce its debts through a successful appeal, which could lead to positive financial outcomes for the company and its creditors.

“Bankruptcy protection is crucial to the debtor’s ability to function as an ongoing business, preserve value for its creditors and stakeholders, provide an orderly process to resolve concurrent claims against it, and pursue an appeal of the SEC’s enforcement action,” said Chris Amani, CEO of Terraform Labs.

– Chris Amani, CEO of Terraform Labs

An Unjustified Fraud Complaint, According to Terraform Labs

The heart of the legal debate lies in the classification of the cryptocurrency tokens issued by Terraform as securities, a claim that the SEC has used to justify its fraud complaint.

The current CEO of Terraform Labs disputes this interpretation, arguing that the tokens in question should not be considered securities under relevant legislation, and therefore, the SEC’s legal action would fall outside of its jurisdiction.

“The debtor disagrees with the district court’s decision and believes […] that the SEC’s enforcement action is thus outside of the SEC’s jurisdiction,” added the CEO of Terraform Labs.

– Chris Amani, CEO of Terraform Labs

This stance has been put forward despite a preliminary ruling from a federal judge supporting the SEC’s claim. It is worth noting that Terraform Labs opted for Chapter 11 protection by filing for bankruptcy on January 21 with assets and liabilities estimated between $100 and $500 million.