SEC Faces Challenges in Cryptocurrency Management and Performance

Key Points:

- The ban on candidates owning cryptocurrencies significantly limits recruitment at the SEC.

- Existing laws do not clearly cover all cryptographic assets.

- The SEC’s ethical and conflicts of interest policies are under scrutiny.

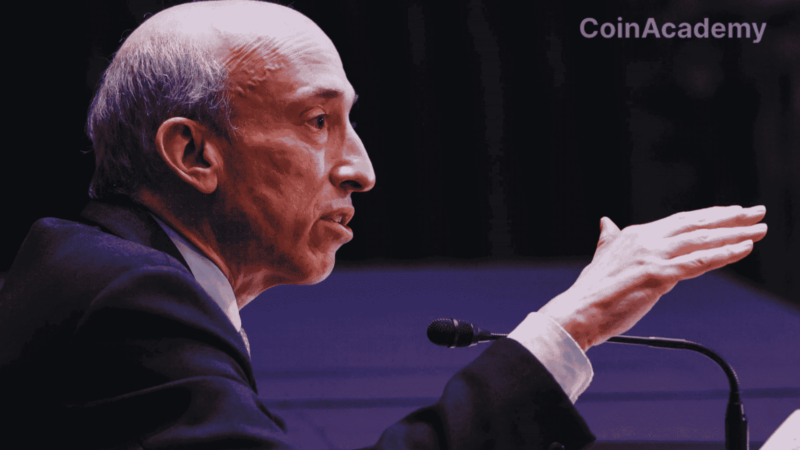

The Office of the Inspector General (OIG) of the United States Securities and Exchange Commission (SEC) has identified cryptocurrencies as one of the main management and performance challenges the agency faces.

In its annual report, the OIG highlighted several already known issues, such as legislative ambiguity and lack of inter-agency coordination. The report also emphasizes the gaps in current legislation, particularly regarding cryptographic assets that are not considered securities.

Recruitment Challenges

According to the report, the SEC is striving to recruit crypto specialists in various sectors (trading, markets, examination, etc.), but many potential candidates own cryptographic assets, which disqualifies them from working at the SEC under a decision by the Office of Government Ethics.

Furthermore, the agency faces a limited pool of candidates and strong competition from the private sector.

In response to these challenges, the OIG plans to closely examine the SEC’s recruitment practices during the fiscal year 2024.

Ethical Issues and Conflicts of Interest

The OIG also responds to external investigation requests and internal reviews. It was called upon to investigate a potential conflict of interest involving former Chief of the Division of Corporation Finance, William Hinman, whose speech stating Ethereum is not a security sparked numerous debates.

However, this claim was not reviewed until June 2023.

In conclusion, the SEC finds itself at a crossroads, facing the need to adapt to the digital age while maintaining rigorous ethical standards.