A New Failure for the SEC in its Case Against Kraken:

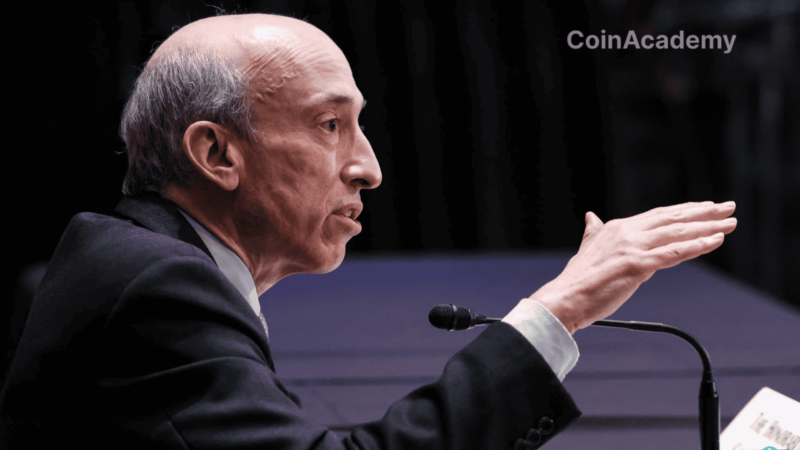

The Securities and Exchange Commission (SEC) of the United States, in its case against Kraken, one of the most popular exchanges in the crypto market, seems to be repeating its past mistakes.

This lawsuit, which accuses Kraken of operating as an unregistered securities exchange, reflects a misguided attempt by the SEC to dominate a sector that defies its archaic regulatory framework.

In fact, this case is not only a repeat of the SEC’s previous failures, but also a stark example of regulatory overreach, showing a fundamental misunderstanding of the nature of cryptocurrencies and the exchanges that support them.

The Role of Cryptocurrencies and Technological Neutrality

Unlike traditional stock exchanges, platforms like Kraken offer a diverse range of digital assets that do not easily fit into the regulatory framework of securities.

This misclassification reveals a lack of understanding of the unique characteristics of cryptocurrencies, which function as decentralized assets often with utility features or currency-like properties rather than conventional securities.

The SEC’s lack of technological neutrality, the principle that regulatory frameworks should apply equally to all forms of technology without favoring or penalizing any particular one, not only hampers innovation but unfairly targets platforms that seek to comply with the regulatory landscape.

Consequences and Perspectives

The SEC’s aggressive stance risks diverting business away from the United States to jurisdictions that are more crypto-friendly.

This phenomenon, known as regulatory arbitrage, could lead to the loss of the United States’ position as a leader in technological innovation.

The case against Kraken is poised to become another example of the SEC’s failure to effectively regulate the cryptocurrency industry, similar to the outcome of its actions against Coinbase. This repetitive cycle of aggressive and ill-informed regulation is not only futile but also undermines the credibility of the SEC.