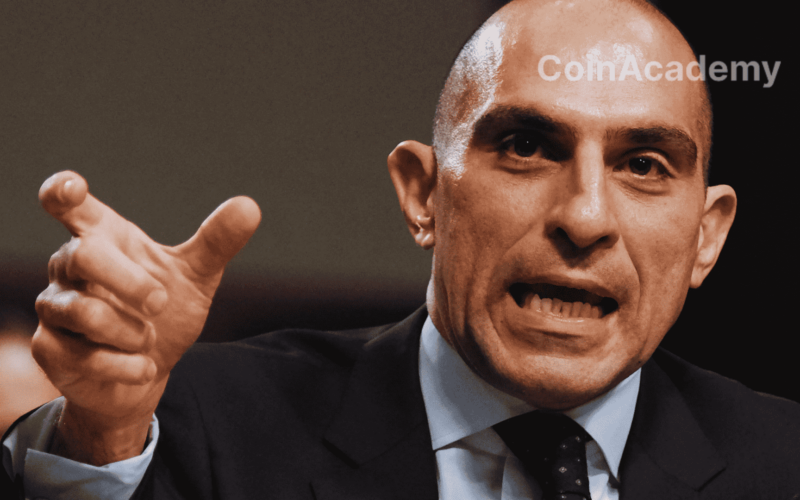

Rostin Behnam Calls for Federal Legislation:

Rostin Behnam, president of the CFTC, expresses concerns regarding the risks introduced by the approval of Bitcoin ETFs in cash. He insists on the need for federal legislation to regulate the cryptocurrency market. Behnam highlights the lack of adequate regulation of digital assets in the cash market.

CFTC Calls for More Regulations for Cryptocurrencies

Rostin Behnam, head of the Commodity Futures Trading Commission (CFTC), recently shared his concerns regarding the approval of the first Bitcoin ETFs in cash by the Securities and Exchange Commission (SEC).

These products, which have generated billions of dollars in trading activity, introduce significant risks. Behnam points out that the technical approval of these products should not be confused with ‘true regulatory oversight of digital asset commodities in cash,’ highlighting the absence of a federal regulatory framework covering the cash markets of digital assets.

I fear that regulatory approval of Bitcoin ETPs may introduce a risk that, despite warning signs, market participants, whether retail or institutional, may mistake technical product approval for true regulatory oversight of commodity digital asset cash markets

Rostin Behnam

Behnam Calls for the Implementation of Federal Legislation

The president of the CFTC reiterates his call for federal legislation to regulate the cryptocurrency sector. Despite several legislative attempts to grant the CFTC new authorities over the cash market, none have yet succeeded in garnering the necessary support.

‘The need for federal legislation on cash market digital asset commodities has never been more critical, and I will continue my call to action.’

Behnam emphasized

Behnam also criticizes the opaque and inconsistent practices in the cash markets of digital assets, particularly regarding conflicts of interest and customer protection.

Finally, he describes Bitcoin ETFs in cash as speculative and volatile products, masked by a thin layer of indirect regulation.