Regulatory Issues Cast a Shadow Over Binance

Binance.US, the American branch of the giant Binance, made a significant decision this week. Direct withdrawals of US dollars from its platform have been suspended following a recent update to their terms of use. Instead of this direct method, users wishing to withdraw their funds in US dollars from the exchange will have to opt for a slightly more roundabout method: first convert their dollars into stablecoins or other digital currencies, and then proceed with the withdrawal, eliminating the possibility of withdrawing FIAT.

This decision is not isolated, but rather the continuation of the firm’s changing stance in the face of increasing regulatory pressure. In June, Binance.US had already suspended dollar deposits. Behind this decision was the assertive approach of the SEC towards the crypto industry, which, according to the firm, made their banking partners reluctant. Binance.US had even warned its user base that banking associates were preparing to suspend dollar withdrawals.

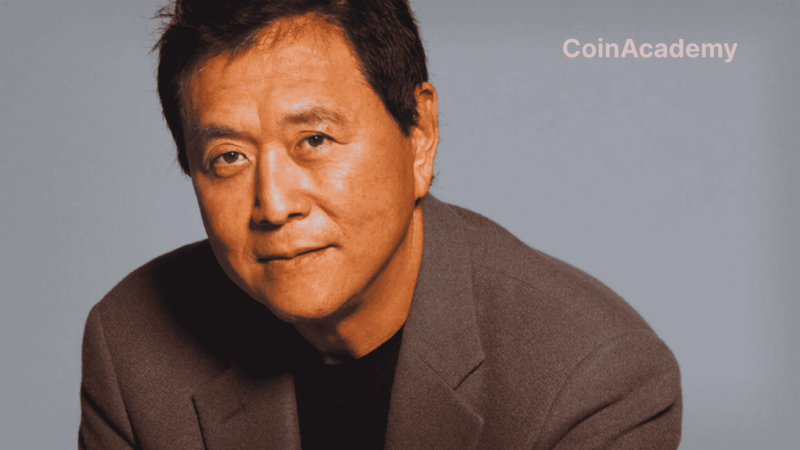

Adding to the tension, on June 5th, the SEC initiated legal action not only against Binance.US, but also against its global counterpart, Binance, and the company’s founder, Changpeng “CZ” Zhao. The allegations revolved around allegations of operating securities platforms without a license. After this trial, the SEC closely examined the firm’s custody practices and its level of cooperation in relation to legal mandates.

Another recent setback for Binance has been the loss of its European payment partner. A successor has yet to be announced. In addition, a significant change accompanying this week’s update is the revocation of FDIC insurance on US dollar funds held in Binance.US wallets, further highlighting the platform’s evolving relationship with financial guarantees.