MicroStrategy: Acquires 11,931 Bitcoin for $786 Million

MicroStrategy, the largest Bitcoin holder on Nasdaq, has acquired an additional 11,931 BTC for $786 million, according to a press release published on Thursday.

Details of MicroStrategy’s Bitcoin Acquisition

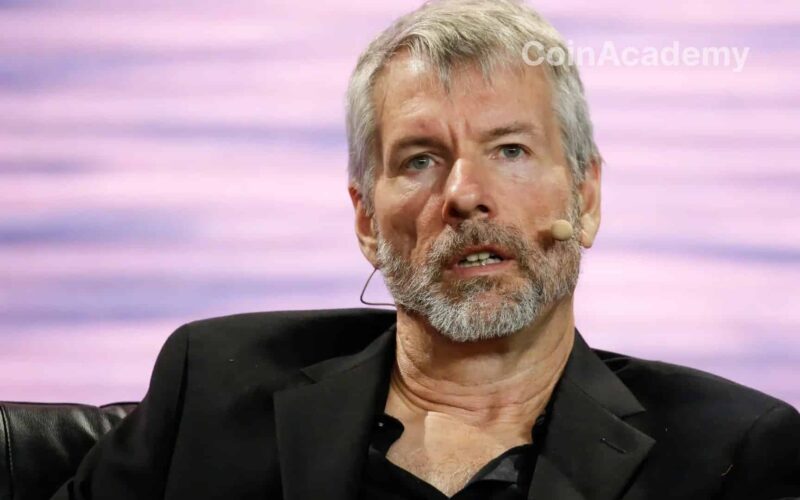

Under the leadership of CEO Michael Saylor, MicroStrategy held 214,400 bitcoins at the end of April. This latest acquisition brings the company’s total holdings to 226,331 BTC, valued at just under $14 billion at the current price of Bitcoin, about $65,000. The company’s bitcoins were purchased at an average price of $36,798 each, totaling approximately $8.33 billion.

This recent acquisition follows an $800 million convertible bond offering aimed at institutional investors. The initial offering was for $500 million, then increased to $700 million, and finally closed at $800 million. In March, the company added 9,245 BTC for $623 million after raising funds in a similar debt issuance.

MicroStrategy’s Bitcoin Accumulation Strategy

Michael Saylor and MicroStrategy began accumulating Bitcoin in 2020. Since then, they have been trying to promote BTC adoption as a reserve asset for other corporate treasuries. While a handful of companies have added modest amounts of Bitcoin to their balance sheets, it is particularly noteworthy that Semler Scientific (SMLR), a US-listed company, has added Bitcoin as a relatively significant cash asset over the past three weeks.

Semler, like MicroStrategy, is also attempting to tap into capital markets to purchase Bitcoin in much larger quantities than its current market capitalization would indicate.

Since MicroStrategy started its Bitcoin purchases four years ago, the company’s stock has increased by about tenfold. Semler’s stock has risen more than 60% since the company revealed its initial Bitcoin purchases at the end of May. MSTR’s stock rose 2% today in pre-market, reaching $1,507.