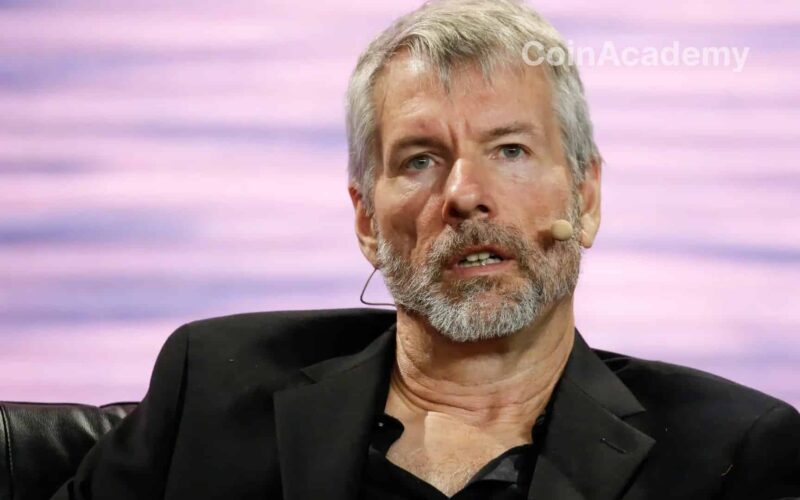

Michael Saylor reasserts his support for crypto self custody

Michael Saylor, the founder of MicroStrategy and a staunch Bitcoin advocate, has reaffirmed his support for crypto self custody in a post published on X (formerly Twitter) on Wednesday. This statement comes in response to criticism from figures like Vitalik Buterin and Max Keiser, who reacted negatively to Saylor’s previous comments endorsing holding Bitcoin through regulated institutions, arguing that it goes against the principles of cryptocurrency decentralization.

Looking back: the controversy surrounding regulation

In a recent interview with Madison Reidy, an economic journalist for the NZ Herald, Saylor encouraged the use of regulated custody solutions, such as those offered by financial giants like BlackRock and Fidelity. According to him, these options would provide better protection against volatility and the risks of loss associated with holding cryptocurrencies.

However, this approach quickly sparked outrage among many members of the crypto community, for whom the philosophy of cryptocurrencies is rooted in decentralization and individual freedom. Several influential voices spoke out, including Vitalik Buterin, co-founder of Ethereum, and Max Keiser, a Bitcoin pioneer.

Vitalik Buterin and Max Keiser disagree with Saylor

Vitalik Buterin’s reaction was particularly striking. In response on X, he minced no words: ‘I would quickly say that Michael Saylor’s remarks are completely senseless,’ he affirmed, criticizing Saylor for advocating a strict regulatory approach. According to Vitalik, this strategy of ‘regulatory capture’ could lead to catastrophic failures, contradicting the founding values of the cryptocurrency world.

Max Keiser also expressed his disagreement, strongly criticizing Saylor’s statements on self custody.

Saylor’s response: a call for diversity in custody methods

In light of these criticisms, Michael Saylor sought to clarify his position in a new message.

‘I support self custody for those capable of it, as well as the right to self custody for all, with the freedom to choose the form of custody and the custodian, whether for individuals or institutions worldwide.’

This clarification aims to ease concerns and show that Saylor does not oppose self custody, but rather considers regulated custody as a complementary option, especially for those who prioritize the security offered by established financial institutions.

A crucial question: centralization vs. decentralization

The debate surrounding self custody highlights two visions of the future of cryptocurrencies. On one hand, proponents like Saylor argue that mass adoption of Bitcoin relies on regulated structures capable of reassuring institutional investors. On the other hand, figures like Vitalik and Keiser defend a more radical approach, where independence from centralized entities is crucial to protect users and encourage innovation.

Jameson Lopp, co-founder of Casa, a company specializing in self custody solutions, has also weighed in, arguing that self custody is essential not only to preserve decentralization, but also to enhance network security and promote participation in governance.

The context: the rise of traditional financial products in Bitcoin

This controversy comes at a time when traditional financial products linked to Bitcoin, such as Bitcoin spot ETFs, are gaining popularity. The 12 Bitcoin spot ETFs available in the United States recently surpassed $20 billion in cumulative net flows, a milestone that Bloomberg analyst Eric Balchunas deemed a ‘major challenge’ in the ETF domain.