Kraken plans billion-dollar debt raise in collaboration with Goldman Sachs and JPMorgan, paving the way for a potential IPO as early as 2026

Kraken, one of the oldest cryptocurrency exchange platforms, is considering raising up to $1 billion in debt, according to sources cited by Bloomberg. The operation would be orchestrated in collaboration with banking giants Goldman Sachs and JPMorgan Chase, marking a significant shift towards the traditional finance sector and serving as a stepping stone towards a potential IPO.

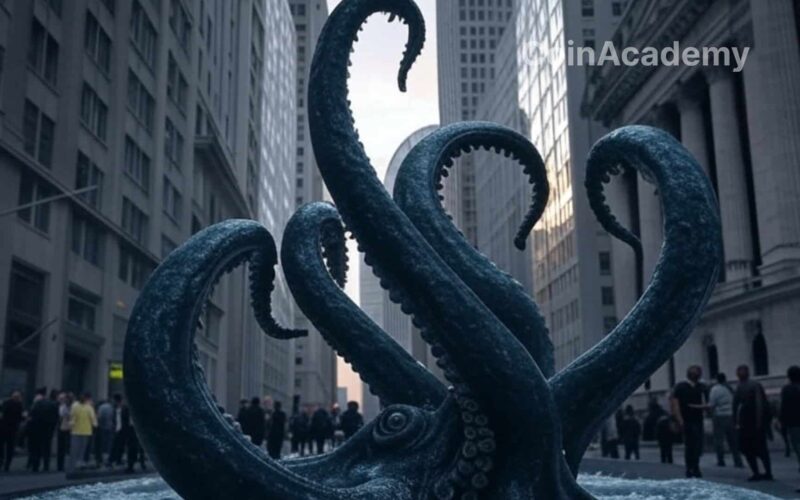

Collaborating with Wall Street to secure funding

Kraken’s discussions with Goldman Sachs and JPMorgan are still in the preliminary stage, as part of a broader strategy to strengthen the company’s finances before entering the public markets. This debt raise would be one of the largest ever for a crypto player, signaling a change in how the ecosystem seeks to attract traditional markets.

An IPO planned for early 2026

Kraken confirmed earlier this month that it is considering an IPO as early as the first quarter of 2026. While the timeline remains flexible, the implicit approval given by the Securities and Exchange Commission (SEC), which recently dropped its lawsuits against the company, opens a long-awaited window of regulatory opportunity.

The favorable context is further enhanced by the fact that Kraken’s American rival, Coinbase, has already been publicly listed since April 2021, becoming a case study for the industry. Kraken’s IPO could be the second major operation of its kind in the US markets, taking place in an environment of gradually stabilizing regulations.

Kraken: Long-term strategy and solid revenues

Kraken’s ambition to join the public markets is not new. As early as 2021, the company hinted at an IPO as one of its objectives. In 2024, it even explored a pre-IPO funding round of over $100 million, demonstrating a consistent interest in structuring its capital around institutional investors.

With over $1.5 billion in revenue recorded in 2024, Kraken boasts a rare financial strength in the crypto industry, often characterized by extreme volatility. This performance positions the company favorably when addressing the question of a public listing.

A strong signal for the crypto industry

The debt raise and the possibility of an IPO at Kraken send a strong message: major players in the crypto industry are professionalizing, aligning themselves with the standards of traditional finance, and seeking to reassure investors. In a climate still marked by past scandals and regulatory instability, Kraken could become the symbol of a new cycle for the industry, where ambition meets maturity.