Is the traditional finance sector tired of the blockchain and cryptocurrency sector? As the bear market persists, the famous bank JP Morgan is growing impatient with Ethereum’s inability to gain momentum.

Over a year after the success of The Merge, Ethereum developers continue to work on its evolution. Last April, Ethereum deployed the Shanghai update, allowing for the withdrawal of ETH deposited in staking.

By the end of the year, developers hope to finalize the launch of the Cancun-Deneb update, which will unveil Proto-Danksharding on Ethereum.

However, despite these promising developments, JP Morgan remains unconvinced.

Learn more about: Google adds 11 blockchains to its BigQuery service

JP Morgan desires more activity on Ethereum

In a recent report, the bank explains that “despite recent updates and Ethereum’s drastic decrease in energy consumption, network activity has been rather disappointing.”

According to the bank’s figures, daily Ethereum transactions have decreased by 12% since the Shanghai update, while active addresses have dropped by nearly 20%. Additionally, the total value locked in DeFi has collapsed by almost 8%.

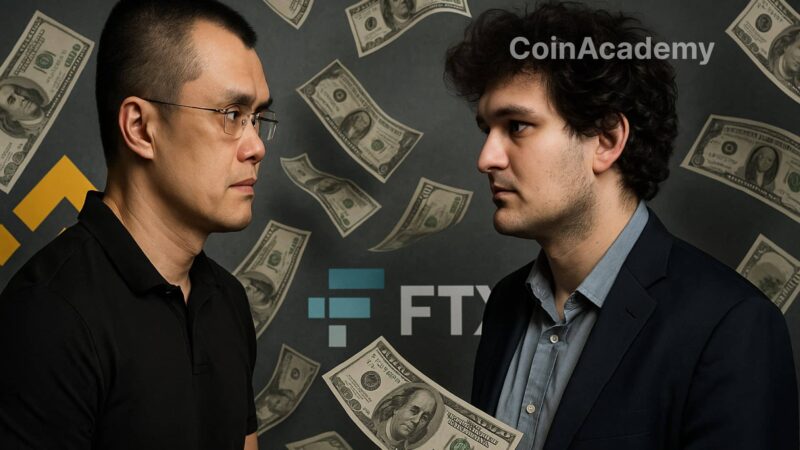

These results demonstrate, according to the bank, “the bearish forces of last year, including the collapse of Terra and FTX, US regulatory crackdown, and stablecoin reductions, have potentially outweighed the positive impact of the Shanghai upgrade.”

Moreover, the bank questions Ethereum’s centralization, especially considering the significance of the Lido protocol within the staking ecosystem.

Due to these factors, the bank highlights that the last hope for 2023 lies in the Cancun-Deneb update. However, it remains skeptical as it believes that “the bear market poses a headwind.”

Nevertheless, the conclusions shared by the bank in its report seem to lack context. In fact, the Shanghai update was not primarily aimed at increasing network activity, but rather Ethereum developers’ strategy is to maximize the importance of layer 2 solutions.

Did the bank truly take these two elements into consideration when drawing its conclusions? Given the tone used in the document, it is highly doubtful.