JPMorgan is no longer content with just using blockchain for payments or repo operations. The largest American bank is now expanding its private network, Kinexys, to alternative fund management, a field still dominated by manual transfers and Excel spreadsheets.

Kinexys Fund Flow: A Revolution in Fund Management

Last Thursday, JPMorgan announced the first transaction on “Kinexys Fund Flow,” in partnership with Citco, one of the world’s largest fund administrators. This new system relies on smart contracts to automate capital calls and money transfers between JPMorgan brokerage accounts and fund managers.

Essentially, investors’ records are tokenized, allowing the system to automatically move funds instantly, reducing errors and delays associated with manual operations. The result: fewer frictions, lower costs, and complete traceability on the bank’s private blockchain.

Citco believes this technology could transform the entire asset management sector, where paperwork and human validations still slow down billions of dollars in flows every day.

Kinexys: The Trojan Horse of Tokenized Finance

The deployment of Kinexys Fund Flow is scheduled to go live on a large scale in early 2026, with new features to follow throughout the year. This initiative aligns with JPMorgan‘s overall strategy: modernizing the global financial “plumbing.” Kinexys already powers the bank’s tokenized deposits, on-chain payments, and intra-day repo tool, launched in August, enabling institutions to exchange real-time liquidity and tokenized securities.

In other words, blockchain is no longer an experimental concept at JPMorgan; it is now a strategic technological foundation.

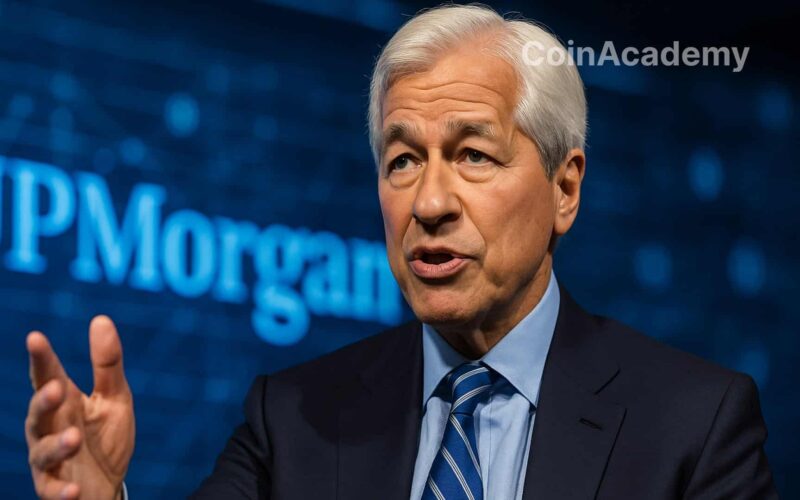

Jamie Dimon’s Change of Tune: “Crypto is Real”

During the Future Investment Initiative conference in Riyadh on Tuesday, Jamie Dimon, a long-time Bitcoin critic, surprised his audience:

Crypto is real. Smart contracts are real. It will be used by all of us to facilitate better transactions and customer service.

A clear shift for a CEO who, a few years ago, labeled cryptocurrencies as a “fraud.” But this time, Dimon speaks from experience: his bank is building the backbone of tokenized finance, far from the speculative chaos of meme coins.

A Profound Transformation of the Private Market

With Kinexys, JPMorgan targets a colossal market: alternative funds, worth over $13 trillion worldwide. By automating their back-office processes, the bank aims to reduce settlement times from several days to minutes, while providing unprecedented transparency to institutional investors.

The line between traditional finance and blockchain is fading more each day. And this time, it is Wall Street itself that is pushing the accelerator.