A new milestone has been reached in the institutional adoption of real-world assets (RWA). The pan-European fund manager APS, overseeing over $13 billion in assets, has made a groundbreaking purchase of tokenized real estate amounting to $3.4 million through the MetaWealth platform. This marks a significant shift for an institutional player in assets that were previously only accessible to the general public.

Deux biens immobiliers à Rome, une transaction 100 % blockchain

The APS investment involves two residential properties located in Rome: Fo.Ro Living and Porta Pamphili. Each was acquired through tokenized bonds amounting to 1.5 million euros, directly available on MetaWealth. A unique feature of this transaction is that it occurred entirely on the blockchain, ensuring traceability, transparency, and instant execution.

Mihai Pop, a key figure at APS, sees this operation as a structural shift in the investment market:

The tokenization provides increased liquidity and new efficiency, while maintaining the regulatory rigor and security expected of institutional players.

MetaWealth rises in real estate tokenization

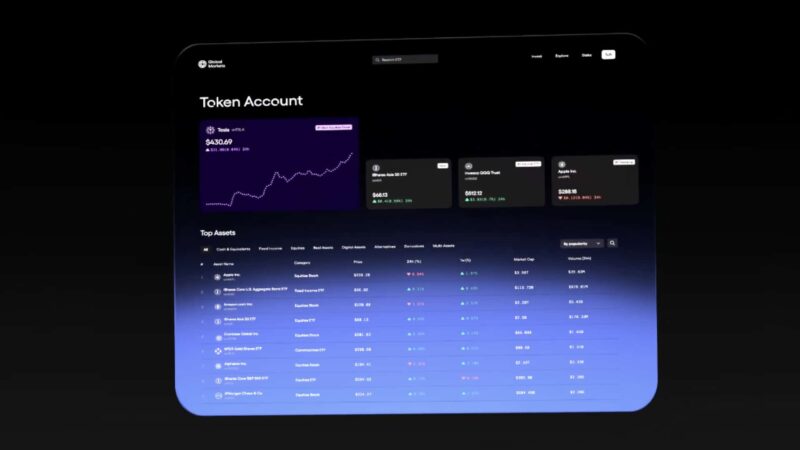

Established in 2023, MetaWealth specializes in tokenizing real estate assets in Europe. Their platform allows for fractional ownership of on-chain registered real estate shares, accessible to both individuals and professionals. To date, over $50 million in assets have been tokenized through projects in Romania, Spain, Greece, and Italy.

With users spread across 23 countries, MetaWealth now claims a spot in the top 10 globally for real asset tokenization platforms.

RWAs in the crosshairs of global finance

The APS purchase comes amid an accelerating trend of initiatives around tokenized real assets. On April 30, BlackRock announced the creation of a tokenized share class for its $150 billion bond fund. That same day, Libre unveiled its plan to tokenize $500 million in debts related to Telegram.

The signals are clear: tokenization, once seen as a distant promise, is now a strategic focus for traditional finance.