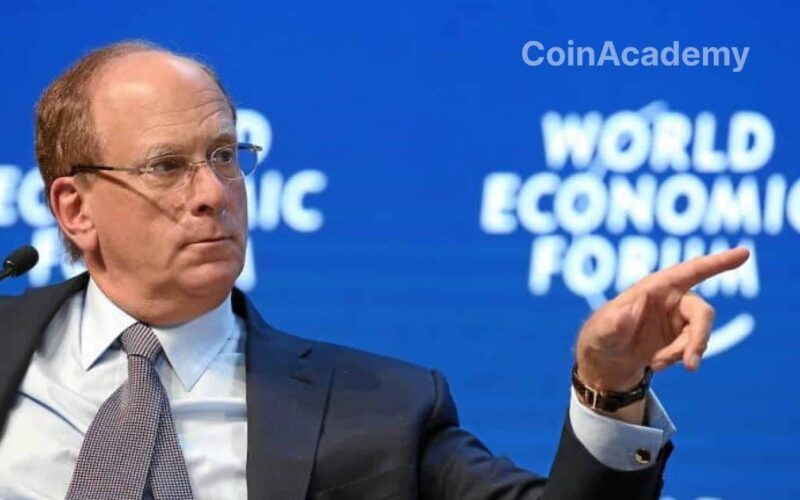

BlackRock’s Bitcoin ETF reached unprecedented trading volumes on Monday, marking a significant milestone for the cryptocurrency-linked financial product. Over 42 million shares of the iShares Bitcoin Trust (IBIT) were traded, amounting to approximately $1.3 billion and surpassing the previous record set at its launch.

Increasing Interest in Bitcoin ETFs

This impressive performance of IBIT reflects sustained interest in Bitcoin ETFs despite increased competition in the field. Bloomberg Intelligence analyst Eric Balchunas described Monday’s trading volumes as “insane” for a recently launched ETF, highlighting the persistent appeal of these investment vehicles to investors.

Records Across the Board

BlackRock’s Bitcoin ETF was not the only one to have an exceptional day. All nine Bitcoin Spot funds in the US saw their trading volumes reach a record $2.4 billion on the same day. With nearly $7 billion in assets, IBIT is positioned as the largest Bitcoin Spot ETF, just behind the Grayscale Bitcoin Trust ETF (GBTC), which started with around $28 billion in assets.

Net Flows and Outlook

Despite a rare day of negative net flows on February 21, Bitcoin ETFs recorded net inflows of nearly $600 million during last week’s four trading days. Trading volumes for Bitcoin ETFs managed by other asset management companies, such as Bitwise, WisdomTree, and VanEck, have also increased, signaling a broadening interest in the sector.