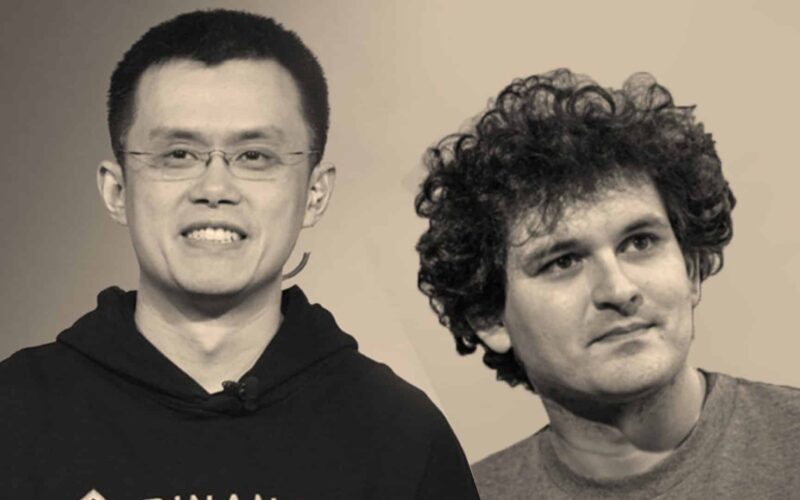

FTX, currently in bankruptcy, is suing Binance and its former CEO Changpeng ‘CZ’ Zhao, claiming $1.8 billion for a fraudulent share repurchase transaction orchestrated by Sam Bankman-Fried in 2021.

FTX claims $1.8 billion from Binance and CZ

The bankrupt crypto exchange FTX has filed a lawsuit against Binance and its former CEO, Changpeng ‘CZ’ Zhao. The legal action relates to a share repurchase transaction deemed fraudulent, orchestrated by FTX’s former CEO, Sam Bankman-Fried.

In July 2021, SBF negotiated the purchase of Binance and CZ’s stake in FTX, financing it with FTX’s native cryptocurrency, FTT tokens, as well as Binance’s BNB and BUSD tokens. These assets were valued at approximately $1.76 billion at the time.

Controversial funding by Alameda Research

The transaction was financially backed by Alameda Research, the trading firm led by SBF. However, Alameda’s financial situation was already precarious at that time. Caroline Ellison, a key figure in Bankman-Fried’s team, expressed concerns in a warning, stating:

We don’t really have the money for this. We’ll have to borrow from FTX to make the purchase.

These revelations, outlined in a filing submitted to the US Bankruptcy Court for the District of Delaware, have confirmed the theory that FTX and Alameda were operating on the brink of bankruptcy.

Tokens without value and a disputed transfer

According to the allegations, the FTT tokens used for the repurchase had no real value at the time of the transaction. This condition, coupled with Alameda’s insolvency, would make the transfer qualify as fraudulent under the law. These details are crucial in FTX’s strategy to recover funds for the benefit of its creditors and stakeholders.

The shadow of Binance and CZ in FTX’s collapse

FTX’s resounding collapse was precipitated by several events, including Binance and CZ’s decision to sell off their FTT holdings on a large scale. This sale led to a sharp drop in the token’s value, significantly worsening FTX’s financial situation. Additionally, FTX accuses CZ of intentionally seeking to harm its competitor by publishing a series of tweets that the exchange describes as ‘false, misleading, and fraudulent.’ These statements, according to FTX, contributed to destroying value that could have been returned to the platform’s creditors.

Another chapter in FTX’s downfall

FTX’s bankruptcy, brought to light after CoinDesk investigations into irregularities in FTX and Alameda’s balance sheets, marks a turning point in the crypto world. SBF was earlier sentenced to 25 years in prison for various fraud charges, with other exchange executives facing different sentences. The legal action against Binance and CZ adds another layer to this complex case, raising questions about shared responsibility in the collapse of the once-thriving exchange.