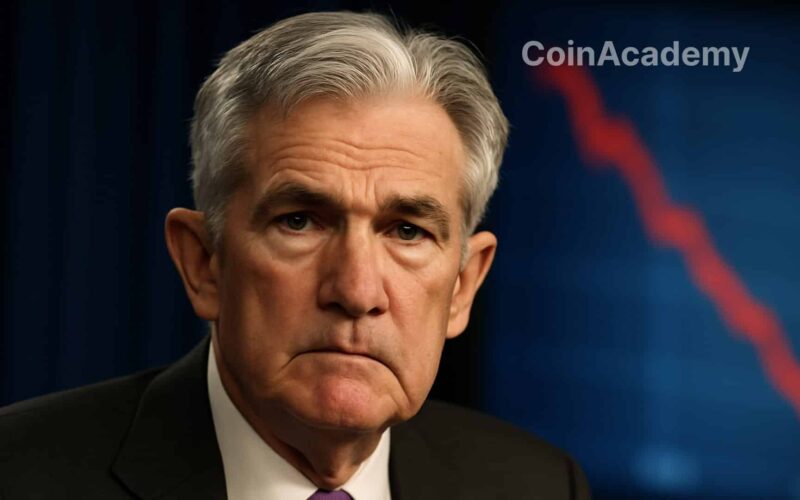

Markets have just hit a rough patch. The odds of a Fed rate cut in December have dropped to 30%. Just a month ago, traders were almost unanimously betting on an imminent easing. The shift is abrupt, reflecting the current atmosphere: maximum uncertainty, minimal visibility, total nervousness.

The bond market, which lives and breathes through rate expectations, has urgently recalibrated. The mechanics are simple: fewer chances of a rate cut, more pressure on the cost of money, more stress for assets sensitive to liquidity. In an environment where every macro data point influences trillions of dollars, a single grain of sand is enough to halt the machine.

The data blackout disorienting the Fed

The situation further complicates with the absence of a key indicator: the employment report. The Labor Department confirmed it would not release the October figures. Reason: the endless shutdown that paralyzed Washington. For the Fed, it’s a statistical black hole at the worst moment.

Without fresh data on job creation, wages, and labor market dynamics, it’s impossible to calibrate a monetary decision. Result: FOMC members are moving blindly. And when the most influential central bank in the world lacks visibility, the entire financial system tenses up.

Furthermore, this chaos is compounded by another equally problematic factor.

Internal divisions further blurring the signal

The minutes of the October meeting confirm deep divisions within the committee. Some members advocate maintaining the status quo, while others want to preemptively cut rates to avoid a too severe slowdown. The only certainty is the lack of consensus.

This lack of unity complicates everything for the markets. Investors have lost a clear compass. Algorithms, on the other hand, interpret this cacophony as an implicit tightening. The immediate consequence: increased volatility, sudden downturns, rapid adjustments of leveraged positions.

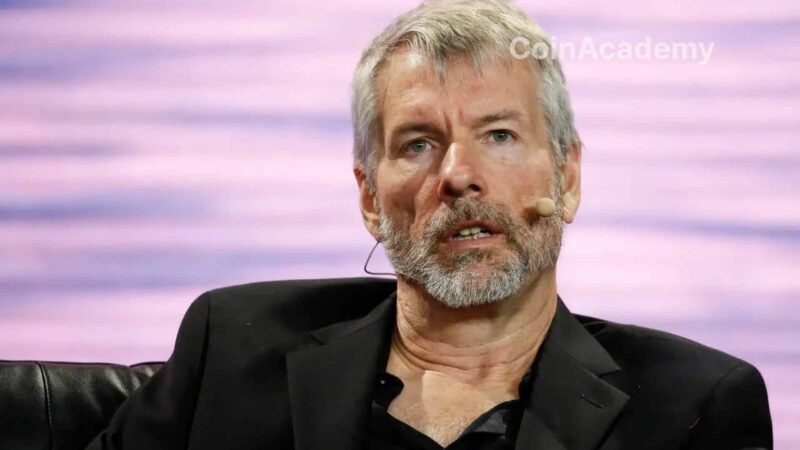

Immediate impact on Bitcoin and tense end of the year

In this macro fog, Bitcoin maintains a slight lead trading around $91,700. A modest rise, but a welcome relief after several days of violent corrections.

The remaining weeks of the year promise to be electric. Between data blackout, internal disagreements, and increasing volatility, the Fed is playing its final card of 2025 in an explosive context. The markets, on their part, will have to navigate without certainty, with one fixed point: the final decision will remain entirely dependent on information that the central bank does not yet possess.

And it is precisely this lack of visibility that makes the situation as dangerous as it is captivating for the crypto ecosystem.