BitMine Immersion raises $250 million to build a strategic reserve in ETH, targeting active participation in staking, DeFi, and Ethereum infrastructure.

Founders Fund, Pantera, Galaxy Digital, and Kraken Ventures are among the giants contributing to this Ethereum-focused strategy.

Thomas Lee’s appointment and the introduction of the ‘ether per share’ metric signal a shift inspired by MicroStrategy’s model, now centered on Ethereum.

BitMine Immersion Technologies is no longer playing small. Known for its liquid-cooled Bitcoin mining farms, the company set a benchmark in energy-efficient mining. With this bold pivot to Ether, BitMine leaves the comfort of the status quo for a daring technological gamble. A strong signal in an industry where few dare to step beyond Bitcoin’s realm.

A Clear Bet: Ethereum over Bitcoin

Until now, BitMine was one of those entities obsessed with Bitcoin. But now, the company is breaking away from its initial DNA. While 95% of publicly traded companies accumulating cryptocurrencies focus solely on Bitcoin, BitMine is taking a different path…

Its goal: to become a key player in the Ethereum ecosystem. The message is clear: Ethereum is no longer just an ‘altcoin.’ It is the infrastructure of digital finance, stablecoins, tokenized assets, dApps, staking. And BitMine aims to directly integrate with it, at the protocol level.

The funds raised will enable the company to build a strategic ETH reserve while participating in the network’s native activities: staking, liquidity, decentralized finance. A strategy that is still niche but could set a trend.

A Fundraising Led by Industry Giants

The investors involved in this round are no coincidence. Among them are Founders Fund, Pantera Capital, Kraken Ventures, Galaxy Digital, and Republic. A lineup of major players endorsing BitMine’s ETH thesis. MOZAYYX spearheaded the fundraising, supported by Cantor Fitzgerald, while ThinkEquity handled the placement.

The price per share was set at $4.50. Since the announcement, the stock has surged by +200% in pre-market trading, hovering around $15. An upswing reflecting market enthusiasm for a strategy deemed bold yet coherent.

This strategic shift didn’t come out of nowhere. Over the past two years, BitMine has been investing in Bitcoin as a treasury asset while operating its rigs at specialized sites in Texas and Trinidad. Its hybrid model of mining + hosting + accumulation laid the groundwork for this new strategy. Except, this time, the goal isn’t just production but anchoring at the core of the Ethereum protocol.

A New Face at the Helm of BitMine

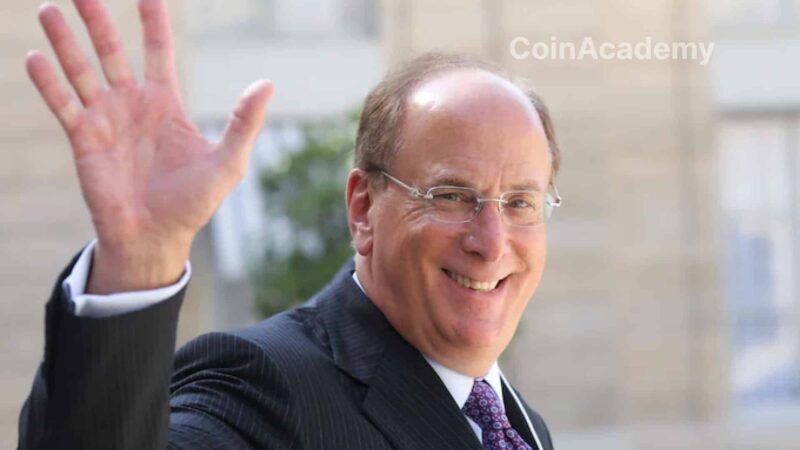

Another significant sign: the appointment of Thomas Lee as Chairman of the Board. A finance icon turned crypto enthusiast, Lee has long been one of the most outspoken advocates for Bitcoin and Ethereum on Wall Street.

His appointment signifies a strategic turning point. He also introduces a new metric to steer the company: ‘ether per share.’ A metric reminiscent of MicroStrategy’s model, tailored to the Ethereum universe.

A Unique Position on the Public Market

BitMine could potentially join the very few publicly traded companies with ETH treasuries. To date, only SharpLink Gaming had dared a similar approach, holding 188,478 ETH in stock. The rest of the market remains fixated on Bitcoin.

For a company historically rooted in Bitcoin mining, this shift towards ETH marks a major strategic turning point. BitMine no longer just wants to exploit crypto; it wants to own it, understand it, and become a cog in it. A decisive strategy, endorsed by markets, that could pave the way for a new generation of crypto treasuries focused on Ethereum.