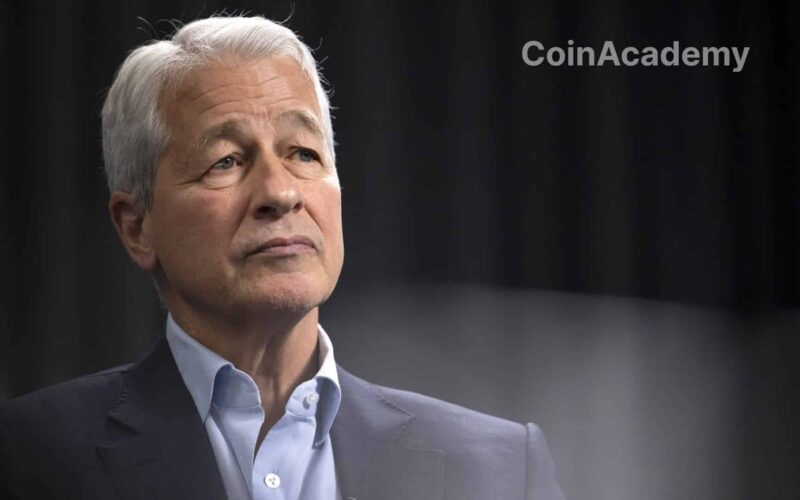

ETF Ethereum Spot May Face Disappointing Launch, Says JPMorgan

JPMorgan analysts predict that the launch of Ethereum Spot ETFs could face a negative initial reaction due to the potential capital outflows from the Grayscale Ethereum Trust and profit-taking by speculative investors.

According to JPMorgan, several factors contribute to lower demand for Ethereum ETFs compared to Bitcoin ETFs, including the lack of an ETH halving event and limited staking options in the ETFs.

JPMorgan forecasts modest net inflows of $1-3 billion for Ethereum ETFs by 2024, contrasting with the record-breaking success of Bitcoin ETFs.

In a recent analysis, JPMorgan highlights the potential initial negative market response to the launch of Ethereum Spot ETFs, unlike the highly positive reception of Bitcoin ETFs.

JPMorgan analysts, led by Nikolaos Panigirtzoglou, anticipate capital outflows from the Grayscale Ethereum Trust as speculative investors take profits. Several factors are identified, limiting demand for Ethereum ETFs compared to Bitcoin ETFs.

The initial market reaction to the launch of Ethereum Spot ETFs will likely be negative.

Factors Influencing Demand for Ethereum ETFs

Analysts point out several reasons why Ethereum ETFs may not generate as much interest as Bitcoin ETFs. Firstly, Bitcoin benefits from being the first-mover and has already captured much of the demand for crypto assets.

In addition, the Bitcoin halving, which occurred a month ago, served as an additional catalyst for Bitcoin ETF demand. In contrast, Ethereum’s Proof of Staking consensus mechanism lacks a similar event that could stimulate demand.

Competition and Attractiveness of Investment Products

JPMorgan also emphasizes the absence of staking options in ETFs, making them less attractive compared to platforms offering staking returns.

Furthermore, Bitcoin is seen as a competitor to gold in portfolio allocations, a role that Ethereum, primarily known for its applications, fails to fulfill. Ethereum’s lower liquidity also makes it less desirable for hedge funds and quantitative funds.

Outlook for Grayscale Ethereum Trust

By comparison, assets under management for Bitcoin ETFs were $59 billion as of May 30, with assets for the Grayscale Bitcoin Trust at $28.7 billion on the day Bitcoin ETFs began trading in January.

In contrast, assets under management for the Grayscale Ethereum Trust were $11 billion on the last Thursday. JPMorgan estimates that around $1 billion could potentially flow out of the Grayscale Ethereum Trust with the start of trading for new Ethereum-based products, due to profit-taking by speculative investors.