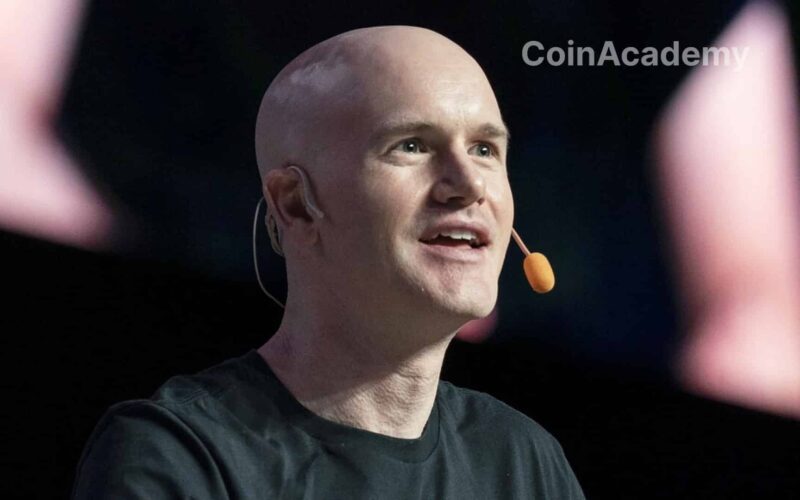

Following its recent regulatory approval from the Bermuda Monetary Authority (BMA), Coinbase Advanced has launched perpetual futures trading for non-US customers. This move is in response to the growing demand for perpetual futures products, as evidenced by the overwhelming dominance of derivatives in the cryptocurrency market. In March 2023, derivatives accounted for nearly 75% of the $2.95 trillion crypto trading volume.

Demystifying Perpetual Futures

Coinbase Advanced allows traders to place bids in USDC on four major contracts: bitcoin, ether, litecoin, and XRP. While the BTC, ETH, and LTC contracts offer leverage of up to 5X, XRP stands out with leverage of up to 3X. Currently, access to perpetual futures trading is only available on the Coinbase Advanced website, but the company will soon expand its offering to mobile trading.

Market Dynamics and Coinbase’s Position

The current market dynamics highlight the aggressive appetite for perpetual futures contracts. In this high-stakes game, Coinbase’s entry not only signifies a diversification of its offerings, but also a strategic attempt to penetrate this lucrative segment. The company, in its blog post, emphasized the benefits of margin trading, highlighting the increased capital efficiency and flexibility it offers traders in managing risks associated with cryptoassets.