The CFTC Commissioner Questions the Legitimacy of the Complaint Against KuCoin

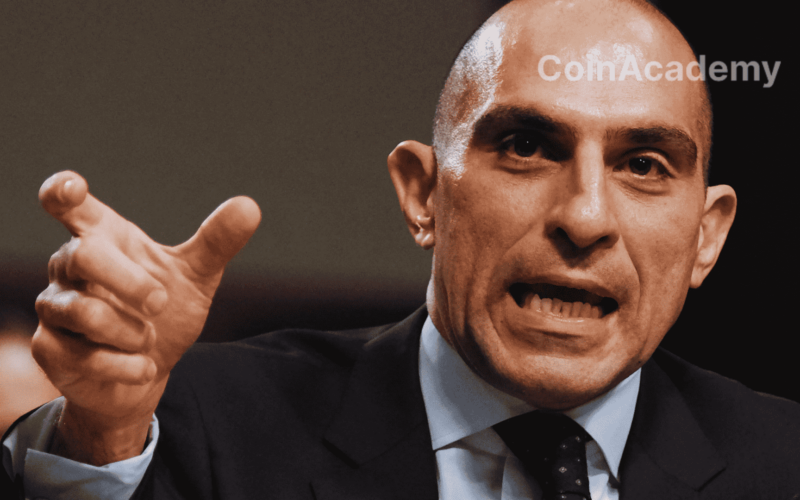

The recent civil complaint filed by the Commodity Futures Trading Commission (CFTC) against cryptocurrency exchange platform KuCoin has sparked reactions within the agency itself. Commissioner Caroline Pham has expressed reservations, suggesting that the action could exceed the limits of the CFTC’s authority.

The CFTC’s approach risks encroaching on the SEC’s authority and undermining decades of robust investor protection laws by confusing a financial instrument with a financial activity, thus disrupting the foundations of the securities markets. Owning stocks is not the same as trading derivatives.

Caroline Pham, CFTC Commissioner

The Classification of Leveraged Tokens in Question

The CFTC’s complaint, filed last Tuesday, classifies KuCoin’s ‘leveraged tokens’ as digital product derivatives, an interpretation that, according to Pham, confuses investments in a fund – typically considered securities falling under the SEC jurisdiction – with the trading activities of a fund, which are attributed to the CFTC’s jurisdiction.

This perspective highlights a potential conflict of competence between the CFTC and the SEC, the regulatory body for the US securities market.

Implications for Cryptocurrency Regulation

Pham criticizes the approach taken by the CFTC, arguing that it could encroach on the SEC’s authority and compromise decades of investor protection laws by confusing financial instruments with financial activities. This regulatory dispute raises important questions about how crypto products are classified and regulated, as well as the respective jurisdictions of the two financial regulatory bodies.

While the SEC has already targeted other cryptocurrency exchange platforms such as Binance and Coinbase, it has not yet taken legal action against KuCoin. The exchange settled charges brought by the New York Attorney General’s Office for $22 million in December last year, for operating an unregistered exchange platform.